By Lucy Komisar

AlterNet – April 17, 2007

When it comes to tax cheats, the government has been

vocal about catching the little guys but doesn’t spotlight the big-time frauds, like Swift Boat financier Sam Wyly, who happens to be a top-tier Republican contributor.

Every year, just before Tax Day, the Internal Revenue Service conducts a dog and pony show to demonstrate how it is cracking down on tax cheats.

Routinely, the IRS focuses on stories that involve crooked tax preparers and small-time taxpayers who try to erase a few hundred and occasionally even a few thousand dollars from their bills.

This year was no exception. At a press conference on April 3, IRS Commissioner Mark Everson announced civil injunction suits against five corporations in Atlanta, Detroit, Chicago and Raleigh that are franchises of Jackson-Hewitt, the nation’s second-largest tax preparation firm, which the IRS accused of routinely faking returns for some of its 100,000 clients.

Jackson-Hewitt is a quickie, low-fee operation. The IRS says stores accepted false W-2s and faked data to get clients the earned-income credit for the poor. The amount underpaid through returns prepared by 125 stores was estimated at $70 million.

While the story made national headlines, the government targeted an operation that catered to little guys, the poor and lower middle class. However, they failed to mention some big-time tax cheats whose fraud was much greater, but who happen to be top-tier Republican contributors. What the press conference should have announced was: Swift Boat financier Sam Wyly cheated the U.S. of at least $300 million in taxes. And, The money that paid for the Swift Boat campaign was your money!

How does someone cheat the government out of that much money and — until now — get away with it?

Megabucks Sam didn’t pull into a mall with a Jackson-Hewitt franchise store. He had expensive help from his bankers and accountants. The scam is detailed in a report issued Aug. 1 by the Senate Subcommittee on Investigations, the result of a lengthy probe by the staff of Sen. Carl Levin, D-Mich.

Everson knows about it because he testified at the hearing that presented the report.

Everson knows about it because he testified at the hearing that presented the report.

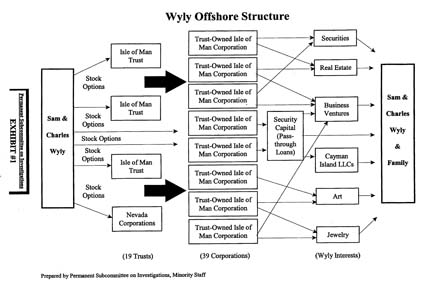

Wyly did his cheating through an offshore scheme that hid $1 billion in profits via Isle of Man shell companies that existed only on paper, were registered under front men to hide the Wylys’ names, and were used to carry out transactions and launder money. And that’s only the hidden income that was found. The Dallas mogul, with a $1 billion admitted net worth, may be guilty of the biggest personal tax fraud in U.S. history.

Wyly used a system popular with megarich corporate executives. In 2000, Bank of America, the country’s second-largest commercial bank, began offering a tax shelter called STARS, which the IRS has ruled illegal. Among the happy clients were Wyly and his  brother Charles, who controlled the $5 billion Michaels Stores, the arts-and-crafts retailer with 900 shops.

brother Charles, who controlled the $5 billion Michaels Stores, the arts-and-crafts retailer with 900 shops.

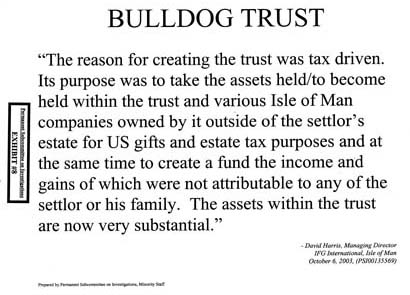

The idea was to evade taxes by giving themselves stock options and transferring them to offshore corporations controlled by secret trusts in the Isle of Man, that famous British tax haven in the Irish Sea. Manx companies are routinely fakes; one of the front men on the boards of all the Wyly entities is a sheepherder, who picks up cash for use of his name.

U.S. law requires major stockholders to report their holdings to the Securities and Exchange Commission. Company officials from Michaels Stores admitted that the Wylys had transferred company securities to offshore trusts and subsidiaries, and that the company and the Wylys had not reported it.

If you want to know how they did it, read the following paragraph. If your eyes glaze over, skip to the next.

How the scam works: A public company grants stock options to a top executive. The executive transfers the options to a trust or partnership controlled by his or her family. The transfer is called a sale and the trust pays for the options with a note due in 20 or 30 years. After the options are transferred, the trust exercises the option to buy stocks which it sells on the market. The executive plays out the fiction that tax is not owed until the deferred payment date, although in fact he controls the profit stashed offshore in a secret account where the IRS can’t find it.

How the scam works: A public company grants stock options to a top executive. The executive transfers the options to a trust or partnership controlled by his or her family. The transfer is called a sale and the trust pays for the options with a note due in 20 or 30 years. After the options are transferred, the trust exercises the option to buy stocks which it sells on the market. The executive plays out the fiction that tax is not owed until the deferred payment date, although in fact he controls the profit stashed offshore in a secret account where the IRS can’t find it.

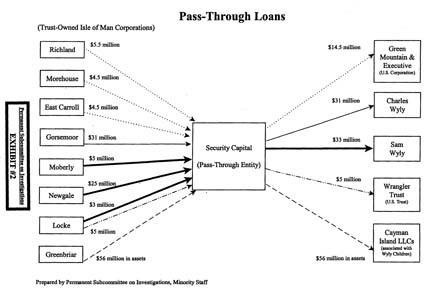

Wyly dumped profits into two hedge funds in the offshore Cayman Islands and laundered that into an investment in an annuity in offshore Bermuda. The annuity was written by a Bermuda reinsurance company he set up himself and which had one client, Sam.

He and brother Charles used some of the tax-evading profits for loans, homes and ranches (two ranches worth $54 million near Aspen, Colo.; condominiums worth $13 million in downtown Aspen; a 95-acre ranch worth $12 million near Dallas; and an oceanfront property worth $8 million in Malibu). He also bought jewelry and art (a Rockwell painting). (These excerpts from inside communications show how that worked.) Why did Bush’s IRS commissioner forget to mention Wyly? He might say it’s because the IRS is investigating the case but hasn’t taken definitive action.

However, there could be two other reasons. One is that Wyly was not only the financier of the Swift Boats fraud to discredit John Kerry during the 2004 presidential campaign, but the Wylys were Bush’s ninth greatest career contributors, Bush Pioneers, who collected $100,000 for the 2000 and 2004 presidential campaigns. (Your money.)

They also funded other leading Republicans. Sam Wyly, since 1997 has given Republicans more than $1 million and his brother Charles and wife have donated more than $1.3 million. Among the beneficiaries were William H. Frist, Wilbert J. Tauzin, Thomas Delay, John D. Ashcroft, Richard J. Santorum, John S. McCain, Mitch McConnell, Dick Armey, Elizabeth H. Dole, Christine Todd Whitman, Orrin G. Hatch, Phil Gramm, Alfonse M. D’Amato, Rudolph W. Giuliani and Arnold Schwarzenegger. They also funded the ironically named Good Government Fund, Freedom Works Pac and Straight Talk America.

But there’s another reason why the Bush administration doesn’t like highlighting Wyly-style tax cheating. The Wylys have a lot of company. Every major private banking department offers a product called the private placement offshore of variable annuities.

According to the IRS, business executives have used such shelters to evade taxes on $8 billion in income. Assume that means at least. And that’s just one swindle in the panoply of tax cheating which the IRS says contributes to the loss of $40 billion to $70 billion a year from individual use and $30 billion from corporate use of tax havens.

Compare $100 billion of offshore cheating to the $70 million headlined by Everson this month.

Those numbers are probably low: According to a Tax Justice Network report quoted by the Senate investigation and based on statistics from Merrill Lynch/Cap Gemini’s World Wealth Report and the Boston Consulting Group’s Global Wealth Report, 16.2 percent of the private wealth of North Americans, $1.6 trillion, is held offshore. The overwhelming reason for that is tax evasion.

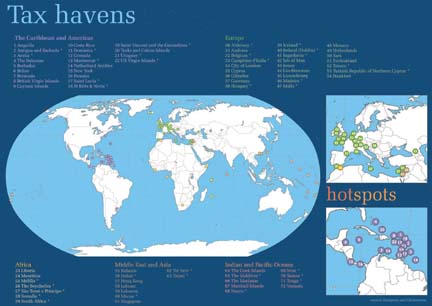

The Wylys’ fraud tells us what we ought to be focusing on in order to stop the mega-tax cheats. Think offshore and tax haven, the parallel international financial system run by the world’s big banks. It is built on a network of more than 70 jurisdictions that in various combinations sell secret shell companies — fake paper fronts — and anonymous bank accounts.

The big time cheaters — individuals and corporations — who evade taxes in the millions don’t go to the mall, they go offshore. The multinational banks run the secret accounts and accept as legitimate the paper shells that own them and that serve the world’s crooks, terrorists, dictators, arms and drug traffickers — and tax cheats.

Banks such as Citibank set up shell companies themselves for clients’ convenience and sometimes have their own employees serve as front men, i.e., directors.

Everson indicated concern at the April press conference about the increasing complexity associated with structured entities and transactions in the international arena and then the offshore area.

But, at the same press conference, when Eileen O’Connor, assistant attorney general for the Tax Division, mentioned the nine-year prison term awarded tax cheat Walter Anderson, who started his fortune with Mid-Atlantic Telecom in Washington, D.C., she didn’t explain that he had evaded more than $200 million in taxes through schemes based in the offshore British Virgin Islands and Panama. The investigation started in the Clinton administration.

The Bush Administration from its first year, when Treasury Secretary Paul O’Neill torpedoed an OECD (Organization for Economic Cooperation and Development) attempt to crack down on tax havens, has shown itself a friend of the shadowy system.

Now, Congress has a chance to act against the offshore tax-cheating Wylys of America. Carl Levin (shown here) and Norm Coleman, a Minnesota Republican who is savvy about the issue because he was a prosecutor, along with Barak Obama, have sponsored The Stop Tax Haven Abuse Act (S-681). It would:

* Presume that nonpublicly traded offshore corporations and trusts are controlled by the U.S. taxpayers who formed them or sent them assets, unless the taxpayer proves otherwise;

* Impose tougher requirements on U.S. taxpayers using offshore secrecy jurisdictions;

* Give Treasury authority to take special measures against foreign jurisdictions and financial institutions that impede U.S. tax enforcement;

* Require U.S. financial institutions that open accounts or entities in offshore secrecy jurisdictions for U.S. clients to report such actions to the IRS;

* Tax offshore trust income used to buy real estate, artwork and jewelry for U.S. persons, and treat as trust beneficiaries those persons who actually receive offshore trust assets;

* Increase the maximum fines on tax shelter promoters to 150 percent of their ill-gotten gains, and on corporate insiders who hide offshore stock holdings to $1 million per violation of U.S. securities laws;

* Prohibit U.S. patents for inventions designed to minimize, avoid, defer, or otherwise affect liability for federal, state, local or foreign tax; and

* Require hedge funds and company formation agents to establish know your customer and anti-money laundering programs like other U.S. financial institutions.

Most of those provisions could have blocked the Wylys’ Isle of Man tax evasion.

Levin said, None of these offshore schemes would work without the secrecy that prevents U.S. agencies from enforcing our laws. Our bill offers innovative ways to combat offshore secrecy. We can’t let the offshore tax havens hide $100 billion in U.S. tax revenues which are needed to protect our troops, fund healthcare and education, and meet the other needs of American families.

But Obama’s presidential candidacy website doesn’t mention the issue. Neither do those of Hillary Clinton, who hasn’t signed on to the bill, or John Edwards or Bill Richardson. If any of them have talked about offshore tax evasion in speeches, it hasn’t gotten coverage. Where do they stand on S-681?

For Democrats concerned about national health insurance and social welfare, blocking offshore tax evasion belongs at the top of the domestic agenda. Senate Finance Committee Chair Max Baucus ought to call hearings to move S-681 down the legislative track.

The next Democratic president needs to sign the bill. He or she also must get America’s G-8 partners to agree to end access by nontransparent financial centers to the world’s major banking systems.

Every year that doesn’t happen, billions of U.S. tax dollars are lost to the black hole of offshore bank secrecy. It’s your money!

Anyone else getting tired of the little guy getting busted while the criminal big guys get off scott-free just because of how much money they send to the White House?? I sure am, and am glad this information is finally getting some air. Remember this when you vote…this is YOUR tax money!!!!

Print this article and mail it to the IRS and to your elected officials. Ask all of your friends to print this article and mail it to the IRS and to their elected officials, too.