By Lucy Komisar

Aug 15, 2007

Siemens,  the German-based multinational technology company that made massive payoffs to get international contracts, has, according to the German press, a bribery slush fund of more than $1.3 billion. It moved money through a network of front companies, mostly in offshore Liechtenstein and the United Arab Emirates. Siemens is being investigated by the U.S. Justice Department and the Securities and Exchange Commission as well as by public prosecutors in Germany and Italy.

the German-based multinational technology company that made massive payoffs to get international contracts, has, according to the German press, a bribery slush fund of more than $1.3 billion. It moved money through a network of front companies, mostly in offshore Liechtenstein and the United Arab Emirates. Siemens is being investigated by the U.S. Justice Department and the Securities and Exchange Commission as well as by public prosecutors in Germany and Italy.

How did Siemens officials move so much money about? Investigators ought to ![]() take a look at Siemens‘ transactions through Clearstream, the international financial clearing house in Luxembourg, whose clients do not undergo the same due diligence scrutiny that regular banks apply (or are supposed to apply).

take a look at Siemens‘ transactions through Clearstream, the international financial clearing house in Luxembourg, whose clients do not undergo the same due diligence scrutiny that regular banks apply (or are supposed to apply).

Although Clearstream‘s 2500 customers are normally banks, brokerages and other financial institutions that move financial paper — such as stocks and bonds — for their clients, Clearstream has made an exception for four non-financial companies. According to Clearstream spokesperson Bruno Rossignol, they are Siemens as well as the Shell Petroleum Group, the Dutch agricultural multinational Unilever, and Capital Lease Plan, which leases cars.

A large number of Clearstream exchanges are of cash, not financial paper. With accounts in their own names, companies can avoid passing through banks or exchange agents — or Swift, which the U.S. has targeted for surveillance. They thus skirt mandated due diligence and record-keeping as well as scrutiny by law enforcement.

When Siemens  was proposed for membership, former clearinghouse official Ernest Backes says, some Cedel employees protested that this violated Luxembourg law. (Clearstream was called Cedel before its merger with Deutsche Börse, the owner of the Frankfurt stock exchange, in 2000.) However, Backes says that management told them that Siemens‘ admission had been negotiated at the highest level.

was proposed for membership, former clearinghouse official Ernest Backes says, some Cedel employees protested that this violated Luxembourg law. (Clearstream was called Cedel before its merger with Deutsche Börse, the owner of the Frankfurt stock exchange, in 2000.) However, Backes says that management told them that Siemens‘ admission had been negotiated at the highest level.

(Click here for more about Clearstream.)

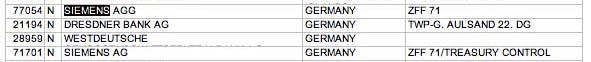

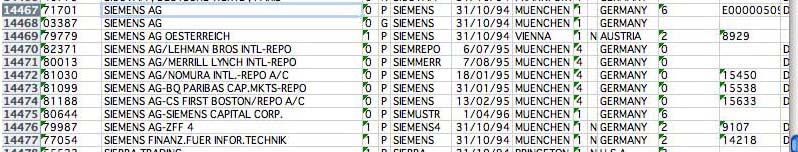

The following — published for the first time — are Siemens accounts in Cedel/Clearstream account lists of 1995, 2000 and 2001.

Clearstream accounts 1995

Clearstream accounts 2000

Clearstream accounts 2001

Clearstream keeps transaction records for ten years.