Lucy Komisar

CorpWatch, May 10, 2005

In mid-May a Moscow court will issue a verdict in the trial of Mikhail Khodorkovsky, the figure behind Yukos Oil, who was once known as Russia’s richest man. Khodorkovsky, who a few years ago was worth more than $15 billion, is on trial for fraud and tax evasion, much of it made possible through the use of offshore shell companies.

Khodorkovsky has been in prison since 2003, when he was charged with embezzlement and for rigging a privatization auction of the petrochemical company, Apatit. Some critics argue that Khodorkovsky is being held up as a symbol of Russia’s ruling class of exorbitantly wealthy businessmen, and that his trial is politically motivated. Senator John McCain – in a recent statement before the Senate – likened the charges against the young oligarch to the overthrow of a government saying, a creeping coup against the forces of democracy and market capitalism in Russia is threatening the foundation of the U.S.-Russia relationship.

But Western corporations and, by extension, the Western media may in fact be equally motivated to obscure the facts and make Khodorkovsky into a capitalist martyr.

Born in 1963, Khodorkovsky is an attractive man who favors aviator glasses. He went to university in Moscow and received an advanced degree in chemistry. Politically active at university, he was the deputy secretary for Young Communists League of Moscow’s Frunze district. He was named head of the local technology business center under perestroika and turned a profit by reselling computers. He then used the cash he made to provide financial services to the first Russian entrepreneurs — organized crime groups. The service changed rubles into dollars and transferred them abroad via offshore accounts.

With accumulated profits, in 1988, he set up Bank Menatep (named after the Russian acronym for Frunze’s Inter-Branch Centre for Scientific and Technological Programs), which prospered under the patronage of Russian entrepreneurs and politicians.

Khodorkovsky hit the big time with President Boris Yeltsin’s loans-for-shares program, through which, it turned out, state assets were looted at rigged auctions for knock-down prices in exchange for loans the government would never repay.

Essential to his frauds was the use of offshore shell companies, artificial fronts set up in tax havens that offer corporate and bank secrecy, no or low taxes, and protection from international law enforcement or minority shareholders seeking to trace the money. While there are about 70 tax havens around the world, Khodorkovsky’s favorites included Switzerland, Gibraltar, Panama, and the Isle of Man, a British crown colony.

Apatit and Avisma

For example, in 1994, Khodorkovsky and his friends bought a 20 percent stake of Apatit, a Russian state-owned company worth $1.4 billion at the time, for a mere $225,000 and a promise to invest $283 million. When the company was put on the auction block, Khodorkovsky arranged for four of his shell companies to be the only qualified bidders in position to buy it. But after winning the bid, the investors failed to inject any money into the company and ignored a subsequent court order to return the shares. Instead they sold the stake to Menatep, which transferred it to offshore shell companies.

Company managers set up a transfer pricing scheme, selling Apatit products at low prices to their shell companies, which sold them on the world market for much more. Meanwhile, taxes and dividends were paid on the low figure. At Khodorkovsky’s trial, prosecutors said this defrauded the company and shareholders of more than $200 million and the country of millions in taxes.

In 1995, Khodorkovsky was responsible for a similar scheme involving Avisma, a titanium company. Again, Menatep Bank owned the winning offshore company. Menatep then set up a transfer pricing network, meaning they used an offshore company to buy Avisma’s output at below-market prices and then sold it for much more, while paying virtually no taxes and reaping hidden profits, which didn’t go to minority shareholders.

Yukos

All this brings us to Yukos, the oil company that was sold in more auctions rigged by Menatep. But this time, the stakes were even higher. Khodorkovsky paid $309 million for a controlling 78 percent of Yukos. The new owners were his offshore shell companies. Months later, Yukos traded on the Russian stock exchange at a market capitalization of $6 billion.

All this brings us to Yukos, the oil company that was sold in more auctions rigged by Menatep. But this time, the stakes were even higher. Khodorkovsky paid $309 million for a controlling 78 percent of Yukos. The new owners were his offshore shell companies. Months later, Yukos traded on the Russian stock exchange at a market capitalization of $6 billion.

Spinning Khodorkovsky

In order to win positive media internationally, Khodorkovsky brought in a savvy public relations executive to chair Group Menatep’s advisory board: Margery Kraus, president and chief executive of APCO Worldwide, a Washington subsidiary of Grey Advertising, one of the biggest advertising agencies in the world.

With the advice of APCO, Yukos created the Open Russia Foundation in London in 2001 with a paltry $15 million to build cooperation between Russia and the West. Henry Kissinger joined the board of the foundation and traveled to Moscow when the U.S. Agency for International Development signed on to a joint project with the foundation to promote Russian democracy. (Also present at this event was George Bush Senior.)

Open Russia Foundation’s grants seemed aimed more at cultivating powerful friends than promoting democracy. A book of photographs of Russia by Lord Snowdon, the official photographer of the British royal family, was commissioned. The foundation also gave $100,000 to the National Book Festival, a favorite charity of Laura Bush, the wife of President George Bush.

APCO also launched a series of advertisements in March 2005 on the international and editorial pages of the New York Times website. Designed to look like a newsletter named Russia in Focus, with no indication of sponsor or ownership, it lists a privacy policy and welcomes reader submissions but no contact information.

One edition included an attack on the Khodorkovsky prosecution co-authored by Stuart Eizenstat (incidentally a member of APCO’s international advisory board) and Jonathan Winer – both former Clinton State Department officials.

APCO claims that more than 98 percent of NYTimes.com’s International section front readers have visited the website www.russiainfocus.com.

In addition to the media campaign, Khodorkovsky also pumped money into powerful and influential investment funds such as the Carlyle Group, run by Frank Carlucci, Secretary of Defense for President Ronald Reagan and a Deputy Director of the CIA during the Carter Administration.

These strategic investments have reinforced Khodorkovsky’s support among U.S. government and political figures. During her recent trip to Moscow, for example, Secretary of State Condoleezza Rice framed the trial as a matter of foreign investor’s rights. Washington will be watching the Khodorkovsky closely, she said, to see what [it] says about the rule of law in Russia.

Perhaps the rule of law and democracy do not include paying taxes?

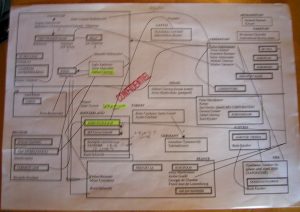

At the top of the Yukos ownership structure is the holding company, Group Menatep, registered at a Gibraltar post office box. Khodorkovsky owned 28 percent of Menatep; Menatep owned Yukos Universal Limited, which owned 61 percent of Yukos. Menatep also owned the intricate web of shell companies in and outside Russia involved in the Yukos tax evasion scheme.

Yukos sold oil and petroleum products to tax haven shells which sold them on the world market. The transfer pricing cheated the government of a number of forms of taxes, totaling $1.7 billion.

Once again transfer pricing was central to Yukos marketing plans. A confidential June 1999 memo obtained by CorpWatch tells of a meeting conducted at the company’s upscale London offices by Stephen Curtis, managing director of Group Menatep, a secretive lawyer who represented a number of influential businessmen (such as Boris Berezovsky, who fled to London after Russian authorities accused him of using offshore shell companies to embezzle money from Aeroflot, the Russian airline, and to cheat on taxes owed by an auto factory).

At the meeting Curtis briefed four others, including Isle of Man shell company operator Peter Bond, about Yukos marketing. He explained that Yukos oil flowed through what they called the Jurby Lake Structure, (an offshore network they’d named after a lake in England) that was based on trading companies like Behles in Switzerland, South Petroleum in Liberia, and Baltic Petroleum in Ireland.

Although these companies had stand alone corporate structures and were thus legally separate, they often shared common offices. For example, Behles, Menatep and Apatit all worked out of 46 rue du Rhone in Geneva, Switzerland.

But in early 2004 Curtis reportedly got nervous about the Yukos frauds and decided to provide information to the National Criminal Intelligence Service (NCIS), which collects information about organized crime in Britain. In March 2004, on his way to meet an MI6 British intelligence agent, Curtis’s new Agusta 109E helicopter crashed, killing him.

Someone close to British intelligence told Financial Times reporter Thomas Catan, My sense was that he was fearful of being prosecuted by the Russian authorities for being party to assisting in the capital flight, and that he thought that going to the UK authorities would give him some sort of top cover.

Meanwhile, Yukos stock had tanked following Khodorkovsky’s arrest in October 2003, wiping out the illusory dividends, and causing U.S. investors to lose $5.7 billion. All along, however, the company’s stolen profits remained hidden in secret bank accounts for shell companies (like Behles) controlled by Khodorkovsky and partners. The following year, Swiss authorities, at Russia’s request, froze $5 billion discovered in the shell company accounts. But even this falls far short of the total back taxes, interest, and penalties owed to the Russian government, which is now estimated at $25 billion.

APCO Worldwide, the Washington public relations firm that represents Khodorkovsky, declined to comment on the transfer pricing and tax evasion system or the charges described here.

Fooling the West

Like Enron, Yukos was a darling of the Western financial press until it collapsed. Also like Enron, Yukos had impressive profits because it used secret offshore shell companies to avoid paying taxes. That worked fine under the rule of President Yeltsin, but changed in 2000 when Vladimir Putin was elected and the new government started to crack down on tax-evasion.

The laws on accounting were also made much tougher in the United States, after the Enron scandal. For example, the Sarbanes-Oxley Act required auditors to certify a company’s internal controls using standards under a newly created Public Company Accounting Oversight Board. Hundreds of companies immediately rewrote their accounts, and auditors began to question company reports much more closely.

The laws on accounting were also made much tougher in the United States, after the Enron scandal. For example, the Sarbanes-Oxley Act required auditors to certify a company’s internal controls using standards under a newly created Public Company Accounting Oversight Board. Hundreds of companies immediately rewrote their accounts, and auditors began to question company reports much more closely.

Menatep/Yukos worked with the big-four global audit firms, Deloitte & Touche, Ernst & Young, PricewaterhouseCoopers, and KPMG, which all routinely set up offshore transfer pricing and tax-evading networks for clients.

The only apparent complaint about the bookkeeping cover-up came from Ernst & Young, the auditors for Khodorkovsky’s holding company, Group Menatep. It wrote in a July 2002 audit that the financial information it was provided did not constitute complete financial statements of the Company prepared in accordance with International Accounting Standards.

Investment banks and brokerages such as Morgan Stanley, Credit Suisse First Boston, and UBS, which were making money from selling Yukos stocks, ignored the results of the Ernst & Young audit.

Khodorkovsky’s lawyers insist that the transfer pricing and other tax-evasion strategies were legal under Russian law. Peter Clateman, a lawyer with Moscow’s Sputnik Group, an investment and development company, disagrees. He wrote on the internet news feed, Johnson’s Russia List, that the Mentap/Yukos operation was a clear transfer pricing scheme that was illegal in Russia, as it would be in just about any western country.

According to Clateman, Many press sources, however, state without further commentary that this scheme was legal in Russia during the period in which it was carried out. I do not know of any Russian lawyer who agrees with this conclusion. As far back as 1998, the Russian government instituted statutes barring transfer pricing schemes, particularly those with the intent to minimize taxes.

The media in the West, on the other hand, seems bent on portraying Khodorkovsky as a victim of politics. Major U.S. media routinely obscure references to the man’s criminality, calling his past murky and the fraudulent privatizations cut-price and controversial.

In one example, a New York Times April 19 editorial called, Justice on Trial in Russia, claimed that Khodorkovsky’s was not a fair trial. Meanwhile, the Times has provided no substantive detail about the actual charges or trial. Furthermore, the U.S. press has largely ignored Menatep companies’ transfer pricing, a scheme invented and popularized in the West that was the key to the Russian fraud.

Major American figures such as Condoleezza Rice and John McCain got on message.

Alexander Vershbow, the U.S. Ambassador to Moscow, said, We are concerned about this escalation of legal pressure being exerted on Yukos. This move will send a very negative signal to companies investing in or considering investing in Russia. Even President Bush, in his recent state-of-the-Union address, called on Russia to stop terrorizing big business.

Cracking down on tax fraud

But, contrary to U.S. press reports, Khodorkovsky and Yukos were not singled out by Putin. Clateman points out that over the last decade Russian authorities have overturned other such structures and demanded back taxes and penalties. Oil major Lukoil settled a $200-million back tax claim for 2000 and 2001 for use of a similar scheme.

Several major oligarchs accused of tax evasion or other financial crimes have chosen exile over prosecution. Boris Berezovsky (Aeroflot and Logovaz) and Roman Abramovitch (Sibneft) fled to London, Vladimir Gusinsky (MOST Bank) to Spain, and Mikhail Chernoy (Trans World Group Metals) to Israel.

Today, Russian authorities have continued the crackdown on tax-evading transfer pricing schemes by companies such as Vimpel Communications, Russia’s second largest cell phone carrier, owned by Alfa Group Consortium. Additional tax charges against Vimpel were estimated at $619 million for 2001-2003, though it has reached a lower settlement on part of the claim.

Alfa, which has also been accused of using offshore networks to cheat investors and business rivals in the past, has business interests in oil and gas, banking, insurance, retail trade, telecommunications and technology. The TNK-BP oil company, in which Alfa has a stake, has been hit with a tax claim for nearly $1 billion for 2001.

Pingback: How Sanctions Against Russia Expose Cracks in Britain’s Political Class – Occasion2B

Pingback: How Sanctions Against Russia Expose Cracks in Britain’s Political Class – YoNews

Pingback: How Russian sanctions expose cracks in Britain's political class - Wake Up UK

Pingback: “Navalny,” documentary nominated for March 12th Oscar, is disinformation : The Komisar Scoop