Audio/Video, Blog, Corporate Abuses

March 4, 2023 – Catherine Austin Fitts writes: “As soon as I learned Lucy had published a new investigation, I immediately asked her to join me on the Solari Report.”

” Lucy found a disturbing pattern. Americans buy an insurance policy. And then quietly, the company starts to move or lower the quality of its assets in a manner that impacts or threatens the value of our policy. Policyholders have no burglar alarm to warn there fundamental change in the deal – or the price at which the deal was made – and we need to pay attention.”

Audio/Video, Corporate Abuses, Scoops

Sept 27, 2021 – Former hedge fund CEO Marc Cohodes discusses in this one-hour interview Overstock’s charges that Cohodes and associates faked reports to drive down the price of Overstock they were shorting, Overstock’s case against Goldman Sachs that it (and Merrill Lynch) used naked shorting to drive down its price, Cohodes’ testimony in that case about Goldman creating shares out of options trades, and why he thinks the Citadel empire should be broken up.

Audio/Video, Corporate Abuses, Scoops

Aug 18, 2021- Democratic Party insider Robert Shapiro, an economist who was a top advisor to the campaign of Bill Clinton, served as his undersecretary of commerce, and then advised the Democratic nominees after him, breaks with establishment economics to target the corruption of naked short selling.

Audio/Video, Corporate Abuses, Featured, Regulation & enforcement

May 20, 2021 – My interview on youtube tells through three dramatic stories how corrupt brokers, hedge funds and their accomplices in government and the media steal from stock market investors. This article includes some of text.

Corporate Abuses, Featured

Consortium News, Nov 21, 2019 – Part of the ongoing U.S. demonization of the Nicolas Maduro government of Venezuela is to accuse it of corruption. In 2017, for example, U.S. prosecutors charged five former Venezuelan officials under the Foreign Corrupt Practices Act (FCPA) with soliciting bribes in exchange for helping vendors win favorable treatment from state oil company PdVSA from 2011 to 2015. (Hugo Chávez was president 2006 to 2013, and Maduro became president in 2013.)

However, there‘s another example of PdVSA bribery that the U.S. never felt compelled to pursue. It is the alleged and never investigated Halliburton bribery of Venezuelan oil company officials in the late 1990s when Halliburton was run by Dick Cheney, who would leave it to become vice-president under George W. Bush.

Blog, Corporate Abuses, Offshore

Jan 15, 2015 – Anne Applebaum wrote an article about Putin’s Russia in the Dec. 18, 2014 issue of the New York Review of Books that was filled with distortions. When I saw NYRB editor Robert Silvers at a Dissent magazine party in New York Dec. 5th, I told him my opinion. He said to send him my comments. But then he declined to print those comments and said that he would run this editorial statement:

Lucy Komisar has written to us that she has a statement to make about the article by Anne Applebaum in our December 18, 2014 issue. This statement is available on her website, The Komisar Scoop. ” The Editors.

Blog, Corporate Abuses

Oct 15, 2012 – If you have followed the stories here showing strong evidence that IDT, the Newark-based telecom, bribed officials of the Haitian phone company, Teleco, you will be interested in today’s SEC filing by IDT. It says that the SEC and the Justice Department are still investigating charges made in 2004 by former IDT employee D. Michael Jewett that the company had paid off Haitian officials in connection with (ie. to get) a contract to supply long distance service between the U.S. and Haiti. That would have violated the FCPA, the Foreign Corrupt Practices Act. At the time, IDT was run by James Courter, the former Republican congressman from New Jersey.

Corporate Abuses, Featured

100Reporters, Jan 19, 2012 — Mitt Romney, who makes his hands-on business experience a talking point in his campaign for the Republican presidential nomination, was a member of the board of directors and audit committee of a global company when it paid millions of dollars to settle charges of extracting kickbacks that cheated clients.

The company is Marriott International and the accusers were hotel owners who had hired Marriott to manage their properties under the Marriott name.

In recent weeks, Romney has come under fire for his role at Bain Capital. But his actions as an independent director at Marriott in the late 1990s and again just two years ago open another window on the candidate‘s record in business and leadership qualities.

Blog, Corporate Abuses, Offshore

Jan 24, 2011 – The lawsuit filed by a former employee against the Newark-based global telecom IDT is over. J. Michael Jewett, who was an IDT executive, claimed in 2004 that he was fired for opposing bribes to Haitian officials. Lawyers for both sides agreed to drop the complaint and counterclaims in an accord filed with the U.S. District Court in Newark on January 13th. This has not been reported before now.

IDT spokesman Bill Ulrey said, We have no comment…as usual. Thank you. Jewett’s attorney William Perniciaro also declined to discuss the matter. When both sides don‘t talk about an agreement to dismiss a case, that normally means a confidential settlement has been reached.

Blog, Corporate Abuses, Featured

Sept 24, 2010 – Last Saturday, Barron’s ran my story in which IDT CEO Howard Jonas admitted for the first time a suspect deal with then Haitian President Jean-Bertrand Aristide that involved sending payments due Haiti to a law firm in the Turks and Caicos. Jonas told me the company had gotten a lawyer’s ethics letter clearing the deal. But he wouldn’t provide it.

A day before the story was to run, Barron’s got a call from a lawyer of the firm representing IDT in a lawsuit by former IDT executive D. Michael Jewett, who says the company fired him for objecting to the offshore deal. He promised to provide the ethics letter. It was the end of day, Friday. The magazine noted that promise when it published the next day.

Days later, the lawyer called to say he couldn’t provide the letter because it was sealed. Hard to believe: there is no sealing order for the letter in the case docket.

Blog, Corporate Abuses

July 21, 2010 –

The global food services company Sodexo, which I exposed last year for exacting rebates from suppliers and charging clients full price, has agreed to a $20 million settlement with NY Attorney General for that illicit practice.

Banks, Corporate Abuses, Featured, Offshore, Scoops

The American Interest, July-Aug 2010 (online May 18, 2010) –

As I write this, the U.S. Senate is debating a major financial reform bill in which the credit default swap, a kind of derivative, plays a significant part. An amendment to that bill, proposed by Senators Carl Levin (D-MI) and Jeff Merkley (D-OR), would ban banks from proprietary trading. There are a lot of high-rolling bankers who do not want that amendment to pass, because it will mess up their plans to repatriate foreign profits into the United States, untaxed, by trading in derivatives on their own accounts. The clearinghouse ICE Trust U.S. forms a central part of these plans.

What is ICE Trust U.S., and who owns it? ICE US Holding Co., which was established in 2008 as the parent of ICE Trust U.S., is located in the Cayman Islands. Yet none of the owners of ICE US Holding Co. are based in the Caymans. Among the owners of the Cayman‘s company are Citigroup, Goldman Sachs, J.P. Morgan, Merrill Lynch and Morgan Stanley, which are headquartered in New York. Bank of America, which now owns Merrill Lynch, is based in Charlotte, North Carolina.

Corporate Abuses, Major Past Articles, Scoops

The Big Money, March 11, 2010 –

When the devastating earthquake hit Haiti in January, IDT, the New Jersey-based global phone company, moved fast to help.

It announced it was setting up calling stations at hotels and other sites so Haitians could use its Internet calling-service to reach family and friends around the world. It cut rates on its U.S. prepaid calling-card to 2 cents a minute to Haiti (at least for 12 days), donated 4,000 $2-prepaid calling-cards to Haitian community groups in New York and Florida, and said it would give some proceeds from prepaid calls to Haitian Red Cross relief.

Such a warm, fuzzy response from a U.S. corporation often wins plaudits, though, of course, IDT has a business interest in the impoverished island. In 2005, in its latest publicly available figures, the company reported $4 million in profits from $17 million in revenues for routing calls there.

Corporate Abuses, Corporate/Wall St., Regulation & enforcement, Scoops

Oct 22, 2009 –

Back in 2004, when Chris Christie was the U.S. Attorney for New Jersey, his office first heard allegations that IDT Corporation, a Newark, N.J.-based global telecommunications company, was involved in a case of international bribery. No federal criminal case was ever brought against IDT, in contrast to several successful federal prosecutions in similar cases elsewhere. The company is run by James Courter, a former Republican congressman from New Jersey.

Fast forward to the present, and Christie is now the Republican candidate for the governor of New Jersey. And, an examination of campaign finance records shows, Christie has thus far racked up $26,800 in campaign contributions – earning him a total of $80,400 including state matching funds ” from 27 individuals who could have a direct interest in the IDT case.

Corporate Abuses, Major Past Articles, Offshore, Scoops

AlterNet, March 26, 2009 –

Congress has deftly avoided the real story of AIG’s collapse, which will make a few million in bonuses seem like peanuts.

Most legislators at a House Finance subcommittee hearing last week deftly avoided the real story of AIG’s collapse. Instead, they homed in on the public relations disaster of hundreds of top AIG officials and staff getting $165 million (later revealed as over $218 million) in bonuses.

The key issue ignored by the congressmen and women was the potential catastrophe represented by as much as $2.7 trillion in AIG derivative contracts and how AIG and the U.S. government are dealing with them. To put that number in context, we’ve so far provided the company only about $170 billion.

Corporate Abuses, Regulation & enforcement, Scoops

How food-service providers like Sodexo bilk millions from taxpayers and customers

In These Times, March 2009 –

The Investigative Fund at the Nation Institute provided generous support for this article.

At the end of the 2006 school year, children‘s nutrition advocate Dorothy Brayley had a disturbing conversation with a local dairy representative. He had come to her office to discuss participation in the summer trade show of food providers she runs as director of Kids First Rhode Island.

At the time, the state‘s schools were buying 100,000 containers of milk each week. The salesman for Garelick Farms, New England‘s largest dairy, told Brayley that Sodexo”a food and facility management corporation that managed most of the state‘s school lunch programs”was paying Garelick more than competitors in order to get a bigger rebate.

That‘s just a taste of the hundreds of millions of dollars of “rebates””or kickbacks from suppliers”that Sodexo, a $20 billion-a-year global leader in the food and facility management industry, has taken while operating cafeterias and other facilities for schools, hospitals, universities, government agencies, the military and private companies across the country, according to evidence provided by whistleblowers and internal company documents.

Corporate Abuses, Offshore, Scoops

Inter Press Service (IPS), Feb 5, 2009 –

President Barack Obama said he would crack down on firms that use offshore centres to evade taxes. He could begin with a New York subsidiary of one of the world’s largest private banks, which used a Cayman Islands company to shift its profits.

Why would a New York investment fund manager run operations through an office in the Caymans? This type of structure is for optimising taxes, explained Max Obrist, a Cayman Islands official of the global Julius Baer Group (Zurich).

He told IPS that generating the income where a company was actually based, you would pay much more taxes. Obrist was describing a company shifting claimed earnings to tax havens to evade home taxes. He allegedly helped Julius Baer Investment Management (JBIM) New York do just that.

Corporate Abuses, Offshore, Scoops

Evening Standard (London), Jan 6, 2009

Gordon Brown and Barack Obama are both promising to crack down on the use of offshore tax havens. But putting those tough words into practice is another matter.

One of the world’s biggest private wealth management groups circulates funds via offices in the Cayman Islands, claiming they take major investment decisions ” when the main work is apparently carried out in London.

With offices in London and across the globe, Swiss-based Julius Baer banking group invests over $300 billion ( £208 billion) in assets on behalf of institutions and wealthy individuals. Profits in 2007 were more than $1.1 billion.

In London, one of its units was known as Julius Baer Investors or Julius Baer Investment Management (JBIM) until a management buyout in 2007. It was renamed Augustus Asset Managers, is based in Bevis Marks in the City, and is still 10% owned by Julius Baer.

From London, Augustus controls assets of $12 billion but claims its profits are generated elsewhere, offshore at a Cayman Islands Baer subsidiary called Baer Select Management.

Why? Simple, really. “If you would generate all the income in London, you would pay much more taxes,” acknowledged Max Obrist, a Cayman Islands executive of Julius Baer.

Blog, Corporate Abuses, Corporate/Wall St.

Sept 2, 2008 –

Michael Glassner, in charge of Republican Vice-Presidential candidate Sarah Palin‘s campaign operations, was till April 18th a vice-president of IDT, the New Jersey-based telecom fined $1.3 million by the FCC in July for failing to file its Haiti contract.

The contract, effective in 2004, revealed payments to an offshore shell company in the Turks & Caicos which sent only part of the fees to Haiti‘s phone company. The case is under investigation by the Justice Department and the Securities and Exchange Commission. A former IDT insider, Michael Jewett, who managed the company’s Caribbean region, says the missing money represented kickbacks to former Haiti President Jean-Bertrand Aristide.

Blog, Corporate Abuses, Offshore

Dec 1, 2007

When there’s a financial crisis tied to lack of transparency, follow the culprits offshore. Evidence comes out now that this is true about the subprime debacle.

Reuters reports that a German bank is implementing accounting changes including consolidation of an offshore conduit whose soured investments triggered a government-led rescue. The offshore operation was set up to invest in subprime mortgages.

Pam Martens in Counterpunch points out that, Citigroup, is discovered to have stashed away over $80 billion of Byzantine securities off its balance sheet in secretive Cayman Islands vehicles with an impenetrable curtain around them.

Among those securities count subprimes. Citigroup has $55 billion of subprime exposure and in November said it would write down up to $11 billion in subprime losses. Goldman Sachs said that won’t be all, that the bank may have to write off $15 billion.

Corporate Abuses, Offshore, Scoops

Inter Press Service (IPS), Aug 30, 2007

U.S. officials from the Securities and Exchange Commission, the Justice Department and the Federal Bureau of Investigation met with Munich prosecutors this week regarding the 1.3-billion-dollar bribe fund run by Siemens, the German multinational technology company.

After talking to the Germans about tracking the financial flows of the largest illicit slush-fund ever discovered, the U.S. investigators would do well to visit Luxembourg on Germany’s western border.

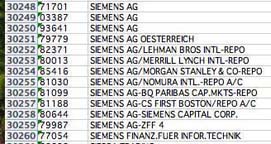

There they could seek information from Clearstream, the international financial clearing house, that might tell them how Siemens moved so much money and where it went. That is because Siemens has the unusual status of being one of only four non-financial companies among 2,500 Clearstream members. It gained membership on the insistence of a former CEO who was fired after a scandal.

Corporate Abuses, Offshore, Scoops

Aug 15, 2007

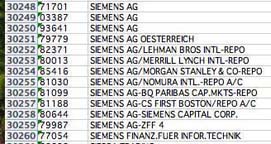

Siemens, the German-based multinational technology company that made massive payoffs to get international contracts, has, according to the German press, a bribery slush fund of more than $1.3 billion.  It moved money through a network of front companies, mostly in offshore Liechtenstein and the United Arab Emirates. Siemens is being investigated by the U.S. Justice Department and the Securities and Exchange Commission as well as by public prosecutors in Germany and Italy.

It moved money through a network of front companies, mostly in offshore Liechtenstein and the United Arab Emirates. Siemens is being investigated by the U.S. Justice Department and the Securities and Exchange Commission as well as by public prosecutors in Germany and Italy.

How did Siemens officials move so much money about? Investigators ought to take a look at Siemens‘ transactions through Clearstream, the international financial clearing house in Luxembourg, whose clients do not undergo the same due diligence scrutiny that regular banks apply.

Siemens is one of only four non-financial companies (out of 2500) with Clearstream accounts. Here — published for the first time — are listings of Siemens’ Clearstream accounts for 1995, 2000 and 2001.

Blog, Corporate Abuses, Offshore

Aug 1, 2007

Where did Rupert Murdoch get $5 billion to buy up the Wall St. Journal? Beyond normal profits, his coffers were stuffed by dodging taxes in the U.S. and elsewhere. Some of that is your money!

The Economist, in 1999, investigated Murdoch’s corporate tax affairs and discovered that a collection of 800 offshore companies help him cut corporate taxes to 6%!

Banks, Corporate Abuses, Major Past Articles, Offshore, Regulation & enforcement, Scoops

Is Citibank Spain a tax cheat?

New Internationalist, Aug 2006

With help from a whistleblower, I followed the money trail through the offshore operations of Citigroup, the world‘s biggest bank, and discovered that Spanish bankers handling their client’s offshore accounts were getting commissions via an internal accounting system instead of on the regular books.

It is the same internal system that Citigroup used in the 1970s to compensate currency traders in Paris, London, Frankfurt and elsewhere who booked trades in the tax haven Nassau, the Bahamas. They were exposed by an insider, were investigated by the SEC and Congress, and had to pay millions in back taxes. Is this happening again?

Corporate Abuses, Offshore, Scoops

This report describes and details a history of tax evasion by the world‘s largest

financial conglomerate, Citigroup. Going back decades, it is a story of

repeated, aggressive tax evasion for itself and clients, depriving governments

and therefore citizens of huge amounts of funds and carried out with relative

impunity.

It moved money through a network of front companies, mostly in offshore Liechtenstein and the United Arab Emirates. Siemens is being investigated by the U.S. Justice Department and the Securities and Exchange Commission as well as by public prosecutors in Germany and Italy.

It moved money through a network of front companies, mostly in offshore Liechtenstein and the United Arab Emirates. Siemens is being investigated by the U.S. Justice Department and the Securities and Exchange Commission as well as by public prosecutors in Germany and Italy.