Featured, Propaganda, Russia

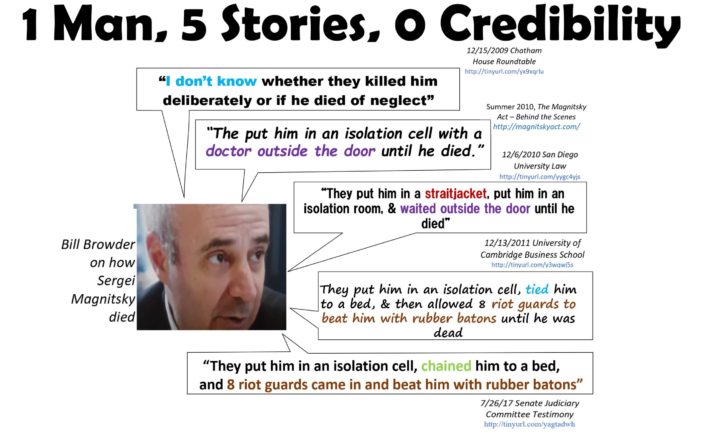

Feb 22, 2023 – How do you make a good propaganda film? How do you expose it before it wins a truth-telling award and embarrasses the prizegivers — before they discover it’s a propaganda pseudo-documentary that has been nominated for an “Oscar” – before the white envelopes are opened before millions of people on Oscar night, March 12th?

Featured

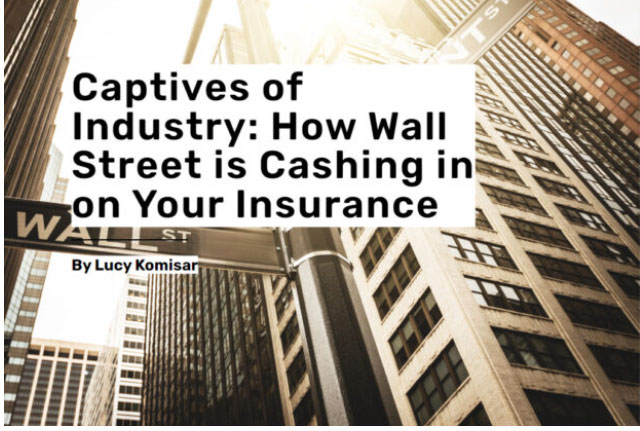

Dec 30, 2022 – Major U.S. life and annuity insurance companies are endangering their policyholders’ benefits

with risky investments that trade client security for bigger payouts for executives and shareholders, according to an examination of financial filings, annual reports, and experts on insurance finance.

Featured

Sept 12, 2022 — Some of Wall Street’s biggest firms are using accounting gimmicks in life insurance companies to bolster their profits by overvaluing their assets and holding risky investments on books in secrecy jurisdictions, according to government, trade union and financial regulatory experts.

Featured

Sept 9, 2022 – Senator Elizabeth Warren (D-MA) asked some tough questions at a Senate Banking Committee hearing yesterday about the danger to millions of Americans having their pensions transferred to private equity firms. She got a “no problem” response from the Treasury Department representative and, not surprising, the same from an insurance commissioner speaking for the association that generally goes along with the interests of the industry.

Books/Film, Featured

May 17, 2022 – The “money quote” in the documentary “Gaming Wall Street” by Tobias Deml, premiered on HBO MAX, is former stock trading executive Tobin Mulshine saying, “I would illegally naked short sale stocks every day. As long as I was collecting commissions, the bank did not care.”

Featured

April 28, 2022 – Here’s a story the New York Times just missed. U.S. politicians and corporate media are promoting the targeting of “enablers” of Russian oligarchs who stash their money in offshore accounts. A Times article March 11th highlighted Michael Matlin, CEO of Concord Management, as such an “enabler,” who handles money of Roman Abramovich. But it missed serious corruption Matlin was involved in. Maybe because it stopped with “he helps the Russian oligarchs we hate.” Looking further would have revealed how he cheated Russia with the help of William Browder, a hero of the NYTimes, which has never challenged the Browder/Magnitsky hoax.

Corporate/Wall St., Featured

The American Prospect, June 22, 2021 – In the aftermath of the GameStop run-up in January, retail investors found telltale signs of a common yet egregious trading fraud by major brokers and hedge funds. What happened around GameStop can be explained only by massive counterfeiting of shares.

Audio/Video, Featured

By Catherine Austin Fitts, Aug 19, 2021 – Lucy Komisar is one of the top financial fraud investigative reporters in the new media. Lucy is known for unraveling the most complex financial frauds – particularly those involving sophisticated cross-border transactions.

When I learned Lucy was doing a deep dive on the GameStop trading war, including the latest on naked short selling oversight and regulation – a problem that has plagued American capital markets for a long time – I had to get her back on the Solari Report. If you have not yet discovered Lucy and her website The Komisar Scoop, you are in for a treat.

Audio/Video, Featured

June 8, 2021 – This is a one-hour video. Click the first arrow to see it all. Starting with why you don’t read or hear this in the corporate media. You can see video segments of it below. With some of the longer key sections in text at the end.

Audio/Video, Featured

June 6, 2021-The Securities and Exchange Commission, set up after the 1929 stock market crash, has been a corrupt operation captured by the stock brokers and Wall Street actors it was supposed to regulate. Here is the history, told in text and in a video I did for Superstonk.

Audio/Video, Corporate Abuses, Featured, Regulation & enforcement

May 20, 2021 – My interview on youtube tells through three dramatic stories how corrupt brokers, hedge funds and their accomplices in government and the media steal from stock market investors. This article includes some of text.

Corporate/Wall St., Featured

The American Prospect, Feb 25, 2021 – At the House Financial Services Committee hearing last week on the GameStop debacle, there was an elephant in the room: naked short selling. A decade ago, a Biden confidant tried to stop it. Now there’s another chance.

Featured

Dec 9, 2020- EU foreign ministers in Brussels December 7 adopted a broad sanctions regime. It’s aimed, they say, at the world’s human rights abusers. It’s a Star Chamber, which is what such tribunals were called in the bad old days before liberal interventionist “human rights.”

Featured, Russia

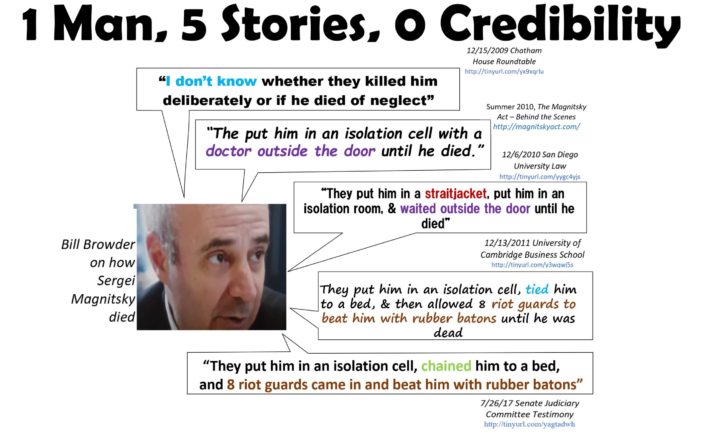

July 6, 2020 – The U.S. and UK, are taking new actions to intensify their collaborative Cold War against Russia. In Washington, calls for sanctions are based on the fake bountygate, the UK has sanctioned selected Russians based on William Browder’s Magnitsky hoax.

Featured

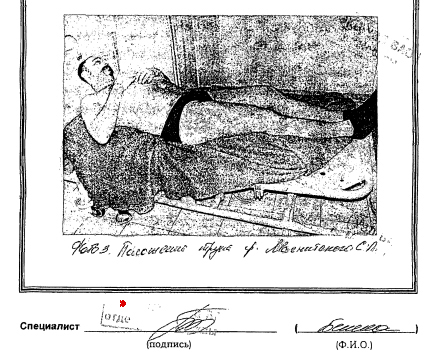

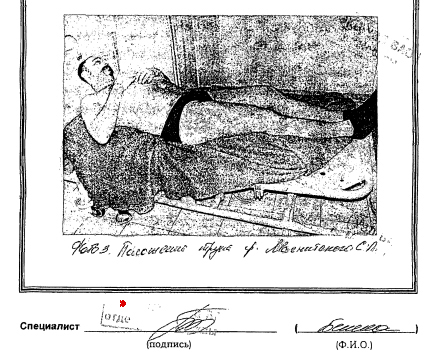

June 1, 2020 – The Australian Parliament Foreign Affairs subcommittee, considering a Magnitsky sanctions act, censors detailed evidence proving claims supporting the act are fake. It redacts key elements, including forensic photos of Sergei Magnitsky, on whose “killing” the act is based, showing no beating marks at all.

Books/Film, Featured

The Nation, Jan 22, 2020 – Mikhail Borisovich Khodorkovsky, MBK in his homeland, is the most famous Russian “oligarch,” the name given by their compatriots to a handful of men who, when communism fell, turned it into gangster capitalism. With an estimated $16 billion fortune, he became the richest man in Russia. When the rules changed, he didn‘t adapt and spent a decade in prison.

Corporate Abuses, Featured

Consortium News, Nov 21, 2019 – Part of the ongoing U.S. demonization of the Nicolas Maduro government of Venezuela is to accuse it of corruption. In 2017, for example, U.S. prosecutors charged five former Venezuelan officials under the Foreign Corrupt Practices Act (FCPA) with soliciting bribes in exchange for helping vendors win favorable treatment from state oil company PdVSA from 2011 to 2015. (Hugo Chávez was president 2006 to 2013, and Maduro became president in 2013.)

However, there‘s another example of PdVSA bribery that the U.S. never felt compelled to pursue. It is the alleged and never investigated Halliburton bribery of Venezuelan oil company officials in the late 1990s when Halliburton was run by Dick Cheney, who would leave it to become vice-president under George W. Bush.

Featured, Major Past Articles, Money Laundering

Nov 6, 2019 – What happens when a major U.S. law firm helps a client steal billions from his victims in the largest Ponzi scheme after Bernie Madoff? When it‘s a well-connected U.S. law firm, nobody goes to jail and it has to settle only for less than 1 percent of the take. And of course, this will be all over the front pages, right? Well, no. You probably don‘t know about it.

Featured, Scoops

100Reporters, Oct 20, 2017 – The controversial New York meeting in June 2016 between Donald Trump’s campaign team and a group of Russians, initiated as a talk about finding dirt on Hillary Clinton, is drawing new scrutiny of US economic sanctions against targeted Russians.

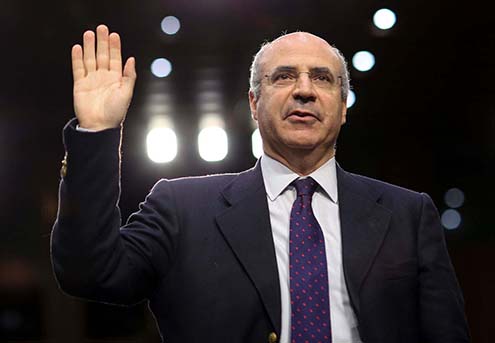

At the meeting, Donald Trump Jr. and other Trump confederates, lured by a promise of compromising information on Trump‘s rival, instead stumbled upon a quagmire: a fraud that bilked the Russian treasury of $230 million; a trans-Atlantic dispute over offshore accounts and tax evasion, and a U.S.-born investor, William Browder, who once ran the largest foreign investment fund in Russia, and who plays the eminence grise in this drama.

Browder is perhaps best known as an investor in Russia turned an anti-corruption activist, and the driving force behind the Magnitsky Act, the battery of economic sanctions aimed at Russian officials.

Featured, Scoops

How Browder & friends cheated Russian tax authority and minority shareholders

100Reporters, May 21, 2014 –

How William Browder & friends cheated Russian tax authority and minority shareholders.

As U.S and European governments impose sanctions on bankers, businessmen and officials close to Vladimir Putin to pressure him over Crimea, the asset freezes will lead investigators not to the Kremlin alone, but to the western-built offshore system that has helped the Russian leader and friends loot their country and consolidate power.

A case – details not public before – shows how westerners – lawyers, accountants, bankers, investors”used the offshore system to facilitate and benefit from Russian corruption.

It involves William Browder (opposite), self-described anti-corruption fighter, known in Washington for winning passage of 2012 “Magnitsky Act,” which presaged current law by blocking visas, freezing assets of Russians accused of rights violations and corruption.

Browder and fellow investors stole funds diverted via an Isle of Man shell from a Russian company they controlled.

Corporate Abuses, Featured

100Reporters, Jan 19, 2012 — Mitt Romney, who makes his hands-on business experience a talking point in his campaign for the Republican presidential nomination, was a member of the board of directors and audit committee of a global company when it paid millions of dollars to settle charges of extracting kickbacks that cheated clients.

The company is Marriott International and the accusers were hotel owners who had hired Marriott to manage their properties under the Marriott name.

In recent weeks, Romney has come under fire for his role at Bain Capital. But his actions as an independent director at Marriott in the late 1990s and again just two years ago open another window on the candidate‘s record in business and leadership qualities.

Featured, Major Past Articles, Scoops

The New York Times, Dec 3, 2011 –

An increasingly cozy alliance between companies that manufacture processed foods and companies that serve the meals is making students ” a captive market ” fat and sick while pulling in hundreds of millions of dollars in profits. At a time of fiscal austerity, these companies are seducing school administrators with promises to cut costs through privatization. Parents who want healthier meals, meanwhile, are outgunned.

Each day, 32 million children in the United States get lunch at schools that participate in the National School Lunch Program, which uses agricultural surplus to feed children. About 21 million of these students eat free or reduced-price meals, a number that has surged since the recession. The program, which also provides breakfast, costs $13.3 billion a year.

Blog, Corporate Abuses, Featured

Sept 24, 2010 – Last Saturday, Barron’s ran my story in which IDT CEO Howard Jonas admitted for the first time a suspect deal with then Haitian President Jean-Bertrand Aristide that involved sending payments due Haiti to a law firm in the Turks and Caicos. Jonas told me the company had gotten a lawyer’s ethics letter clearing the deal. But he wouldn’t provide it.

A day before the story was to run, Barron’s got a call from a lawyer of the firm representing IDT in a lawsuit by former IDT executive D. Michael Jewett, who says the company fired him for objecting to the offshore deal. He promised to provide the ethics letter. It was the end of day, Friday. The magazine noted that promise when it published the next day.

Days later, the lawyer called to say he couldn’t provide the letter because it was sealed. Hard to believe: there is no sealing order for the letter in the case docket.

Featured, Major Past Articles, Offshore, Regulation & enforcement, Scoops

Barron’s, Sept 20, 2010 –

Scoop summary: Howard Jonas, CEO of U.S. telecom IDT, in an interview with Lucy Komisar, acknowledges for the first time that then Haiti President Jean-Bertrand Aristide in 2003 met with an IDT official during discussions about a contract to pay Haiti Teleco for calls from U.S. customers. That contract included agreement for IDT to send payments to a shell company in the offshore Turks and Caicos Islands. Jonas said IDT got an ethics letter from a law firm clearing the deal, but the lawyer said in a memo filed with the court, published here for the first time, that he simply told IDT to do due diligence. IDT signed the contract the next day.

A former IDT official, who objected to the deal, was fired and is suing the company; trial is set for Nov 9th. The Justice Department and Securities and Exchange Commission are investigating violation of the Foreign Corrupt Practices Act. Jonas’s revelations are likely to have a major impact in the trial and investigations.

Banks, Corporate Abuses, Featured, Offshore, Scoops

The American Interest, July-Aug 2010 (online May 18, 2010) –

As I write this, the U.S. Senate is debating a major financial reform bill in which the credit default swap, a kind of derivative, plays a significant part. An amendment to that bill, proposed by Senators Carl Levin (D-MI) and Jeff Merkley (D-OR), would ban banks from proprietary trading. There are a lot of high-rolling bankers who do not want that amendment to pass, because it will mess up their plans to repatriate foreign profits into the United States, untaxed, by trading in derivatives on their own accounts. The clearinghouse ICE Trust U.S. forms a central part of these plans.

What is ICE Trust U.S., and who owns it? ICE US Holding Co., which was established in 2008 as the parent of ICE Trust U.S., is located in the Cayman Islands. Yet none of the owners of ICE US Holding Co. are based in the Caymans. Among the owners of the Cayman‘s company are Citigroup, Goldman Sachs, J.P. Morgan, Merrill Lynch and Morgan Stanley, which are headquartered in New York. Bank of America, which now owns Merrill Lynch, is based in Charlotte, North Carolina.