By Lucy Komisar

May 29, 2019

William Browder, the owner of the Hermitage Fund, who was run out of Russia in 2006 for tax evasion, is still battling Russian law enforcement authorities attempting to collecting on multi-millions of dollars of tax he failed to pay during his decade as the country‘s largest foreign investor. He has just gone to court in New York to counter yet another Russian indictment for tax evasion. His lawyer is the firm of John Ashcroft, attorney general in the George W. Bush administration.

Case 1:19-mc-00262-JMF Document 6-1 Filed 05/28/19

Case 1:19-mc-00262-JMF Document 6-1 Filed 05/28/19

In December 2018, the Russians charged Browder and Hermitage with massive tax evasion, including failure to pay taxes on profits from sale of shares of Gazprom, the major Russian energy company, and fraudulent bankruptcy of one of his companies to wipe out its tax bill. The numbers add up to 3.4 billion Russian rubles, now about $52 million, though at earlier exchange rates it was about $70 million.

Hermitage, which denies the Russian charges, instead claims that it is the Russians who are crooks.

In a political response that has nothing to do with the Russian charges, Browder has filed a petition in US Federal Court Southern District of New York to get documents from 13 banks that have correspondent accounts for numerous other banks, most from Eastern Europe, to get records he says will prove that unnamed Russian officials and their collaborators stole a substantial portion of a tax refund fraud routed through the New York banks.

The tax refund fraud was money stolen from the Russian Treasury in a collusive legal scam in which one group of fraudsters accused collaborators of cheating on a contract, the targets accepted the charge and paid the demand, then deducted that from their annual profits and filed for a tax rebate: $230 million.

The filing says bank accounts were opened in December 2007 in the name of misappropriated Hermitage companies at two very small Russian banks: USB and Intercommerz. U.S. correspondent accounts with Citibank, N.A. and J.P. Morgan exist for both USB and Intercommerz through an Austrian bank called Raiffeisen.

The filing says Russian crooks got the embezzled funds converted to dollars through correspondent accounts at New York banks, including Bank of America, Bank of China, Bank of New York Mellon, BNP Paribas, Citibank NA, Commerzbank AG, Credit Agricole CIB, Deutsche Bank Trust Co Americas, JP Morgan Chase Bank NA, Mashreqbank Psc., Standard Chartered Bank, UBS AG, Wells Fargo Bank NA.

They are said to be correspondent banks holding accounts for banks in Latvia, Cyprus, Kazakhstan, Kyrgystan, Moldova, Estonia, Dubai, Emirates, Ukraine, UAE, Denmark, Zurich, Lithuania.

And Browder, who says the crooks were a cabal of Russian officials, wants to get bank documents to prove it. The filing admits it can‘t get evidence of the beneficiaries of the tax refund in Russia because the funds were converted to US dollars and routed via US banks. But it says it can show the conspiracy‘s end result: millions of dollars channeled through two New York banks to the ultimate beneficiaries of the fraud”persons or entities other than Hermitage.

We would all like to see what these bank documents show. Except there‘s a missing piece. There is no connection between theft in Russia and deposits in New York. So those accounts can‘t prove anything. Though if this case gets to court, it could be the first time that Browder‘s claims of banks transfers are ever examined.

Meanwhile, it‘s useful to look at other claims in the legal action.

Magnitsky

Start with his claim that the Russian tax evasion prosecution against him is politically-motivated “in retaliation against Mr. Browder for his human rights campaign to hold corrupt Russian authorities accountable for their role in a fraud and murder of Hermitage‘s lawyer, Sergei Magnitsky.”

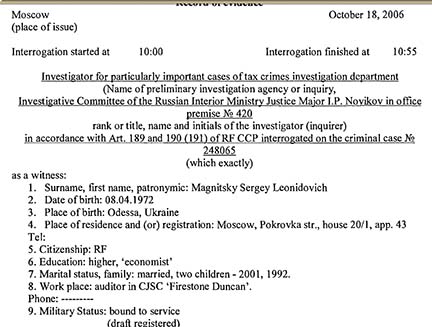

Except that Magnitsky was his tax accountant, not a lawyer, and there is no evidence that authorities or anyone else murdered him. (See Browder‘s testimony and the Moscow Public Oversight Commission report.)

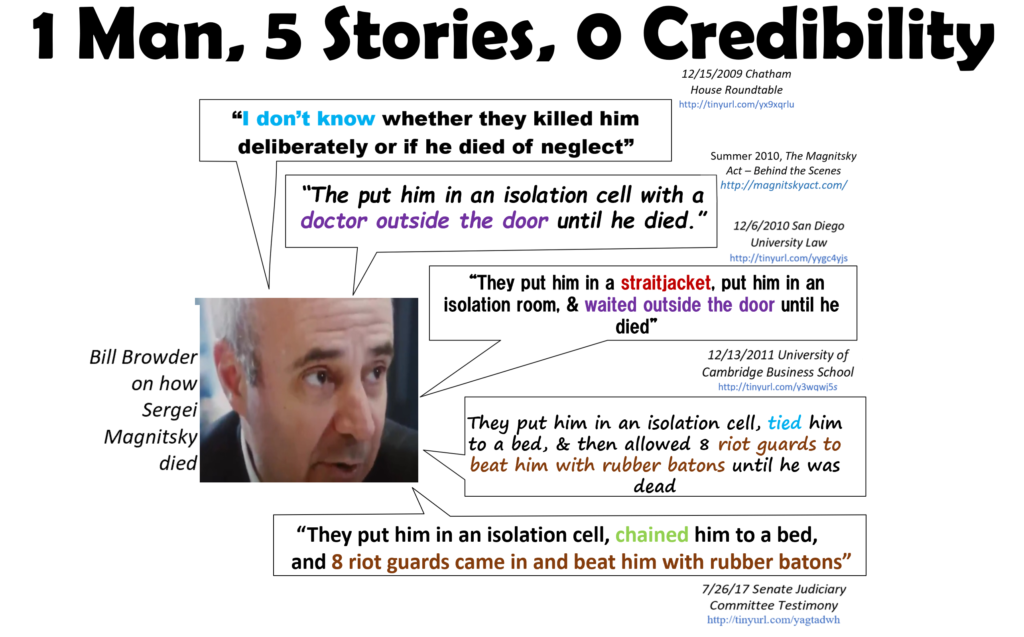

Then he says the fraud was “uncovered by Mr. Browder, Hermitage, and their lawyer, Mr. Magnitsky, who was arrested by Russian authorities for reporting the crime, held in prison, denied medical care, beaten, tortured, and killed in Russia in 2009.”

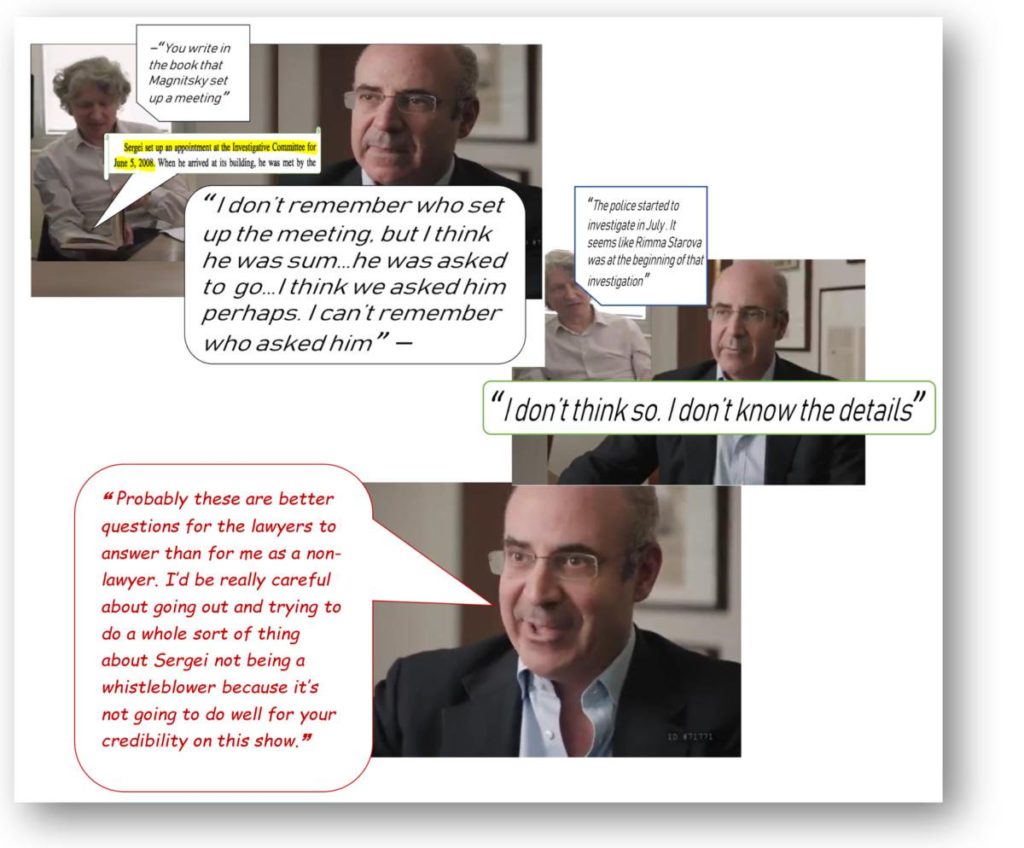

False. The fraud was reported by Rimma Starova, the nominee/front name for Boily Systems, which had acquired the Hermitage shell companies. (See her first testimony to police April 2008 and her second in July 2008. Magnitsky didn’t mention it till testimony he was summoned to give in October.)

And as indicated, Magnitsky was an accountant not a lawyer. He was arrested in the investigation of Browder‘s tax evasion, which he had overseen. He indeed did not get proper medical care but was never beaten or tortured. Browder has provided no evidence for that claim. The Moscow Public Oversight Commission, which produced the only accepted report of Magnitsky‘s treatment and death, says he died of illness not properly treated.

The Search

The Hermitage filing says that “In 2007, corporate records and seals located in Hermitage‘s Moscow office and Hermitage‘s Moscow-based law firm were seized by officers of Russia‘s Interior Ministry. The seizure took place under the pretext of a government search warrant relating to an investment company, called Kameya, which is owned by an international client of Hermitage. Despite the narrow scope of the underlying investigation, records and documents for over 20 companies unrelated to Kameya were seized during the raid.”

Pretext is a loaded word. Translate it to reason. Kameya was cheating on taxes. When you find a company is organizing tax cheating for one client, you check into others.

The filing says “The Treasury paid $230 million at the request of the fraudulently-appointed directors of the misappropriated Hermitage Companies within two days, despite the fact that HSBC and Hermitage had filed criminal complaints three weeks earlier informing the authorities of the fraudulent re-registration, fictitious liabilities, and fraudulent court judgments.”

That was December, but HSBC knew of the re-registrations in July. It filed a financial document then indicating it was adding $7 million to a legal fund to deal with the re-registered companies. Its comptroller Albert Dabbah testified about that in US Federal Court.

The July HSBC filing says, “Following the payout of $230 million from the Russian Treasury, an attempt was made to bankrupt and liquidate the misappropriated Hermitage Companies. Hermitage anticipates the same parties involved in obtaining the fraudulent judgments and refunds were involved in the bankruptcy and liquidation.”

Except that Browder was the one who bankrupted Dalnaya Steppe! He admits that in his book Red Notice. And it was the basis of a case filed in London against Browder by the Dalnaya Steppe bankruptcy trustee which was dropped only when HSBC agreed to pay the Russian claim.

The Discovery

The new Hermitage filing says: “At the end of July, 2008, following their discovery that the Russian Treasury had paid out the fraudulent tax refund to the perpetrators of the theft of the Hermitage Companies, Hermitage and HSBC filed seven more criminal complaints.” But that was after Rimma Starova “discovered” it. The Hermitage alleged “discovery” came second.

The filing says, “In November 2008, Hermitage attorney Sergey Magnitskiy was arrested for the alleged tax underpayment of two Hermitage companies in Kalymkia in 2001. Magnitskiy had no formal relation to the companies in 2001, and had also, shortly before the arrest, given several sworn witness statements with respect to the fraud against Hermitage and the involvement of Russian Interior Ministry officers.”

First, Magnitsky was an accountant, NOT an attorney. He had no connection to Kalmykia in 2001, but Browder admitted in his deposition he had a connection in 2002! He had never given statements about fraud and involvement of officers before his arrest. That claim is a fabrication which Browder cannot substantiate.

The filing says, “Four months after the raid of Hermitage and Firestone Duncan, Hermitage‘s Moscow-based law firm, Hermitage lawyers discovered notices from the St. Petersburg Arbitration Court that the misappropriated Hermitage Companies had been the subject of recent legal proceedings initiated by an unknown plaintiff named Logos Plus. These Hermitage Companies were being overseen by HSBC, as trustee of the Hermitage Fund. Neither Hermitage nor HSBC had been notified of any lawsuit or legal proceedings in St. Petersburg.”

UNTRUE. Four months would be October. But mailing receipts filed in US Federal Court in the Prevezon case show notices were received by the Hermitage companies at their old addresses in July. The receipt for Rilend is dated July 24th.

The filing says to change ownership of Russian companies, one needs the corporate stamp, the official charter, the original tax certificate, and the original corporate registration certificate. Not true. Magnitsky even testified that he made a duplicate of the stamp.

More details to come.

The Hermitage filing is so full of falsehoods, that any banks wishing to challenge it will have an easy time.

Amazing research as always Lucy!

Pingback: Russian Indictment of Browder for tax evasion and tax refund fraud – The Komisar Scoop