Revelations of “Naked, Short & Greedy” by Susanne Trimbath

By Lucy Komisar

March 26, 2020

As stocks are in free fall, a scam run by the big banks/broker-dealers for the benefit of themselves and their hedge fund clients threatens to worsen the situation of large and small American companies and investors.

It‘s when the bank/broker-dealers buy stocks, pocket the money and fail to deliver to clients the shares they are supposed to settle through the national stock clearing house. In another industry that might be called embezzling.

Dr. Susanne Trimbath, an economist who worked in operations at depository trust and clearing corporations in San Francisco and New York, is a national expert on this. She served as senior advisor on a U.S. Agency for International Development project to develop capital market infrastructure in Russia after the fall of communism. She was a consultant on similar projects in several other countries, including Romania and Poland.

The most blatant form of the fraud is naked short selling. Short selling, permitted by the stock market system, allows traders to sell shares they don‘t own. They are supposed to borrow or buy them and transfer them to the buyer within two days. They are hoping the value of the shares they sold drops and that they can buy them to deliver or pay back the loan more cheaply, and make a profit.

But in a system wracked with fraud, traders engage in naked short selling, when they sell stock they don‘t own and never buy to deliver. So now there are two shares, the real one that was never delivered and a phantom “entitlement” given the unsuspecting buyer which is recorded as such by his broker. And which the buyer can now sell! Because the brokers pretend there are real shares there.

Making two shares out of one is among the swindles that crashed the market in 1929. It was called “watering the stock.” Daniel Drew, an American stock speculator, is credited with describing the early naked short selling: “He who sells what isn’t his’n, must buy it back or go to pris’n.”

The world‘s biggest stock fraudster, Bernie Madoff, wrote from prison February 3, 2012, “It was perfectly proper to short [my clients’] securities or purchase those positions back from those clients or others with any profit or loss recorded on my books. … The point is that this was my practice prior to the time that I fell into my crime of staying Naked Short. The fact that the prosecutor and Trustee seemed clueless of this is why my frustration is so great.” He added that “most of my professional clients were well aware of how I traded.”

Trimbath, author of the new book, “Naked, Short and Greedy, detailed the current dangers in direct quotes and paraphrases below.

Musical shares

Trimbath said, “I frequently compared fails to deliver to a game of musical chairs, or as I called it “musical shares.” As long as the music keeps playing, everyone keeps walking around the chairs. When the music stops, someone ends up without a seat. In “musical shares,” as long as the money keeps flowing in, everyone continues trading stocks. Once the money stops – and this is where fails transactions are like a Ponzi scheme – someone has to end up without their shares. When the global financial markets collapsed, lots of people found out that they did not have a seat.”

She said data from the New York Stock Exchange (NYSE) showed that before the 2008 crash, institutional owners (banks, brokers, and pension funds) had 113% of the issued and outstanding shares Freddie Mae and Fannie Mac, the mortgage lenders. Individual investors and non-institutional holders also held some of those shares, evidence that more shares were sold than ever existed.

How the brokers & favorite clients make money by cheating

After the 2008 crash, the big stock traders, to tap into the lush Wall Street bailout, became banks. So, the behemoths, J.P. Morgan, Citi, Bank of America, are now both banks and broker-dealers, stock traders. Their clients are the big institutional investors, hedge funds and big money investors as well as the smaller brokers most individual investors deal with. When Willy Sutton was asked why he robbed banks, he replied, “Because that‘s where the money is.” Except, now the banks are doing the stealing

Let‘s go back to Madoff‘s naked short selling.

Why naked short? When one broker can sell shares to your broker and simply fail to deliver at settlement, the broker does not have to bear the expense of stock borrowing. And the system lets them. Or they could avoid the expense of borrowing by short selling shares and marking them long. Sometimes, when the sellers really own the shares, their brokers may not transfer them to buyers. That and naked shorting both yield fails to deliver.

If the shares ever arrive, the broker sends the money to the seller‘s broker. But once the trader knows that the broker agrees to fail to deliver his sell orders, he or she knows that all fails will persist and is free to naked short millions of shares for years to wait for the desired price drop.

People who buy the undelivered shares get an “entitlement,” and the money they paid stays with their broker, who can use it, interest free. The dollar value of shares purchased but not received is a free loan from the investor to the broker. The investors don‘t know. The broker is not required to tell the client that he took the payment and did not receive any shares.

Stock lending

By signing a retail broker account agreement, investors allow the broker to lend their shares to other investors, including short sellers who are betting that the stock price will fall, and will promote that through naked shorting, which adds to the number of shares in circulation, reducing their value. Such a stock tumble is the opposite of what ordinary investors are hoping for.

She also warned that stock lending to cover shorts can create phantom shares even without naked short selling/fails to deliver because there is no due date for the return of the shares. When the shares an investor leaves at the broker have been lent, he/she owns a phantom share until the loan is repaid. The central depository system encourages this by letting brokers lend even such phantom shares.

Trimbath worked in Russia after the fall of communism. She said, “We refused to give them shorts or stock lending in 1994 because of the known risk factors.”

How bad is it and why should we care?

Securities and Exchange Commission: In the first two weeks of July 2019, 914,261,864 shares valued at over $17 billion failed to deliver in settlement from the clearing house, an average of about $1.9 billion every settlement day.

Fails to deliver harm entrepreneurs in search of capital for building their companies. Instead of investors buying shares the companies issue, they buy phantom shares through their brokers. Fake shares push down the value of all shares by increasing the supply. This impairs the company‘s ability to access capital.

It also distorts other aspects of financial markets. The investor with a phantom share can sell it, lend it, or pledge it as collateral for a bank loan. So can the owner of the real share.

Some more “ordinary” criminals also use the system. A fraudster can set up a hundred offshore companies, establish a brokerage account for each one, and then buy and sell shares among them to multiply shares through shorts and fails. Unwitting investors buy what does not exist, and brokers routinely turn that money over to themselves and the criminal sitting offshore.

Individual investors don‘t know that the system is set up for this. And that the “regulators” enable it.

How this affects shareholders – the example of CMKM “UnShareholders”

CMKM was a Canadian company with an interest in diamonds. The shareholders didn‘t know that mineral rights they were told about were owned by the founders, not the company. Criminal and civil complaints ensued. A reform management changed the company name to New Horizons Holdings, Inc with a plan to raise capital for the purchase of oil or gas assets. If successful, they would be able to return the shares to trading status with the hope of restoring value to shareholders.

NHH directed all shareholders to obtain their stock certificates and exchange them for new shares. That‘s when the masses of phantom shares and corruption of some big brokers came into stark view. Many investors discovered that their brokers had taken their money and never bought or received CMKM shares.

Trimbath, who worked investigating the scam, calls theses victims “UnShareholders,” investors who reported that their share positions were deleted by their brokers and/or where brokers refused to provide them with share certificates registered in the investors‘ names so they could meet the exchange requirements of a “bona fide shareholder.” She said, “Documents I saw suggested three brokerage firms probably took payments from investors for shares that were never received from the selling broker… Charles Schwab, Chase Bank and RBC Dain.”

The investors had “phantom shares.” They were allocated a fail to receive on the broker‘s own books, but payment money was taken from their cash accounts, and they continued to receive statements showing share positions for CMKM.

She said, “Investors submitted documentation showing that each of these brokers deleted their CMKM share positions at a time when we can demonstrate that the firms had no shares either in the depository or on the books of the issuer.” They deleted the evidence of the phantom shares.

How might this work for other shareholders

When settlement failures happen, the shares you buy may not be in your brokerage account regardless of what your broker statement says.

Let‘s say that your broker gets one of these fails to receive. First of all, they don‘t tell you that they got a fail to receive. If you were an institutional buyer or a high-value client, they will tell you that they failed to receive and they will give you some monetary compensation for the delay and inconvenience. They don‘t tell individual retail investors. If they did, they would have to share the revenue they earn on investors‘ money already paid them for the shares, since brokers don‘t have to transfer money for shares they fail to receive.

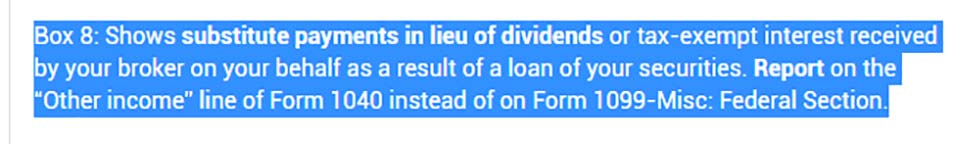

The question then becomes, “Well, how did I get dividends?” You didn‘t really get dividends, you got “dividends in lieu.” That means the broker sent money (maybe part of your money) as dividends. You will know this if your 1099 from the broker says “unqualified dividends.” They are generally considered ordinary income and not eligible for dividend tax rates.

Sometimes, a large broker with many clients seeking the same stock will receive only part of a particular share order. Some clients get real shares, others phantom entitlements. Trimbath said an investor might ask, “How did I get picked out for that?” She said, “The problem is, we don‘t know. And they won‘t tell us. If you were assigned the fail to receive, then the broker has many options, none of which they have to tell you.”

How this affects who has power over corporations.

Before the 2008 crash, at an annual proxy meeting, Bank of America counted 130% of its shares voted, that is, they received 30% more votes than they had shares outstanding. That‘s just the number of people who actually voted their shares! Imagine how many shares were sold beyond what they actually authorized and issued. This violates the voting rights of shareholders and reduces effective corporate governance.

Trimbath pointed out, Let‘s say it‘s the merger of Compaq and Hewlett Packard. Let‘s say that there are a lot of these extra shares around and they have more votes than shares coming in. And let‘s say that your broker/dealer is JP Morgan, who was actually one of the advisors on that merger deal. They stood to gain more in fees if the merger went through than if it was voted down. Do you think that they would be so careful about your vote that if you voted against something they were in favor of that they would not be tempted to only turn in the votes that they thought should be counted, those that were most favorable to their position, as opposed to trying to make sure that everything was done according to the rules. But, there are no rules! They just make them up as they go along.

She said, They can, in fact, throw out your vote and just not count it. They can randomly assign your vote to some real proxy that wasn‘t voted. They can vote what shares they actually do have proportionally based on how many phantom votes come in. It‘s all done in secrecy. They don‘t have to tell you, they don‘t have to tell the NYSE, they don‘t have to tell anyone. They don‘t have to tell the company whose shares they voted.

And the SEC isn‘t interested. To deal with over-voting, the SEC didn‘t say, Stop telling clients they have voting shares when they don‘t. It said, Don‘t submit more votes than shares you are holding. And brokers could choose which votes they wanted to submit!

Attempts to reform 2004 – Reg SHO

One of the original requirements in the final SEC Reg SHO (for short sales) approved in 2004 was to require that all trades be marked “long” or “short,” where prior practice was only to mark “short” trades. A broker could mark a trade “long” only if the seller had full control of the shares when the sale was entered (or was “reasonably expected” to have them). Trimbath said, “The problem is that when a broker fails to deliver, they can retrospectively declare a sale short by reporting that they failed to mark the trade short or vice versa as it suits their needs. Or that it was a long trade where they “reasonably believed” the customer had the shares. Normal investors are not allowed to trade that way, but the brokers are.”

She said the NYSE members are required to report fails to deliver and fails to receive in their quarterly and annual balance sheets. But they report total numbers not the specific stocks. So one really can’t tell much from the numbers, and how could anyone check they are correct?

She said, “The main problem is that Reg SHO has no real teeth for enforcement. The brokers are never called to be responsible for their behavior.” The lack of any punishment creates the conditions for moral hazard, where the brokers see there are no consequences for this trading corruption.

The fails to deliver were about $6 billion a day in 2003. Then, two years after Reg SHO was implemented, fails to deliver were still affecting 20% of NYSE and NASDAQ listed firms and about half of the firms trading over-the-counter. They spiked going into the 2008 financial crisis.

The stocks of these well-known companies had fails to deliver reported in their shares every trading day during December 2007: Virgin Mobile, PNC Financial, Netflix, JP Morgan Chase, Krispy Kreme, HSBC Finance, Icahn Enterprises (with Carl Icahn as Chairman of the Board), Wells Fargo, E-Trade, Morgan Stanley, Deutsch Bank, CIT Group (Citibank), Bank of Nova Scotia, and Bear Stearns. Not even IBM (13 of 20 trading days with fails) and Microsoft (13 days) escaped the creation of phantom shares.

SEC failure

Even a university economist who spent 2004 at the SEC studying fails acknowledged in so many words that the broker-dealers do it on purpose. Leslie Boni (now with a hedge fund in Southern California) attributed the extraordinary increase in settlement failures to investment decisions known as “strategic failures.”

Trimbath noted that in 2007, “The Federal Reserve Bank of New York‘s Treasury Markets Practices Group (TMPG) describes several intentionally abusive practices such as “slamming the wire” (holding back deliveries until immediately before the close with the intention of causing settlement fails) and requests from traders for settlement operations to “hold the box” (a demand to delay settlement of an executed trade). The fact that these practices are colloquially named and described in such detail indicates that they are common causes of settlement failures.”

The SEC continued to declare that fails to deliver were not an indication of naked short selling. That changed when Goldman Sachs and other financial firms needed to be protected. Trimbath pointed out that not till the banks/broker-dealers began to see massive numbers of fails to deliver in their own shares did the SEC put a short-selling ban in place – but only for the shares of banks, insurance companies and securities firms, including the very culprits responsible for the dirty system.

SEC‘s July 15, 2008 Emergency Order temporarily required all persons to pre-borrow or arrange to borrow the securities of 19 select financial firms prior to effecting a short sale order. Trimbath commented, “This order was cronyism, plain and simple.”

The General Accounting Office published two reports:

(1) Securities and Exchange Commission: Oversight of U.S. Equities Market Clearing Agencies (February 26, 2009);125 and (2) Regulation SHO: Recent Actions Appear to Have Initially Reduced Failures to Deliver, but More Industry Guidance Is Needed (May 12, 2009.)

GAO concludes that the SEC neglected to investigate even one of the thousands of complaints received about naked short selling and fails to deliver in the years leading up to the 2008 financial crisis. Five years later, in 2013, the SEC fined the Chicago Board Options Exchange $6 million for failure to enforce or even fully comprehend rules to prevent abusive short selling. It was a slap on the wrist.

2008, Lehman and Bear Stearns

Despite the ban on short selling, the fails to deliver continued to accumulate. Trimbath said that phantom shares resulting from naked short selling are implicated in the 2008 demise of Lehman Brothers, Fannie Mae, Freddie Mac and Bear Stearns. She examined the fails to deliver of Lehman Brothers and Bear Stearns reported to the SEC, the short selling reports from the stock exchanges, and the closing prices for both firms. She calculated that the fails to deliver explained between 30% and 70% of the variation in closing prices. Brokers had many more shares recorded in the investor accounts than they ever really owned.

When it filed for bankruptcy, Lehman listed $163 billion in debt. As of December 31, 2016, according to the notes to its annual financial statements, DTCC had paid out $5.3 billion in cash and securities to the Trustee in charge of winding down Lehman‘s accounts, “including the close-out of pending transactions,” meaning fails to deliver.

The senior managers at both Lehman and Bear Stearns publicly blamed naked short selling for much of their problems.

Who runs the system – DTCC (Depository Trust and Clearing Corporation), a privately-run central clearing agency in New York‘s financial district.

Trimbath blames the massive fails on the DTCC and its subsidiaries, DTC (Depository Trust Company), the vault that holds the shares, and NSCC (National Securities Clearing Corp), which clears and settles trades, that is, handles the exchange of money and shares which are registered in the accounts of its members, the big banks/broker-dealers.

The Securities and Exchange Act of 1933 specifically gave the clearing house the right to require that shares and securities be delivered for settlement. It allows them to punish those who don‘t deliver by refusing to have them in the system.

Trimbath said, “The DTCC has for years ignored that.

She said, “The 2007 Reg SHO amendment says you cannot short again without borrowing: but only DTCC and SEC know who failed to deliver, so how is that functional?”

Till 2013, in fact, the NSCC had a program to automatically borrow shares from DTC members to cover fails before settlement. DTC members can still lend shares from their accounts.

She said the DTCC creates a mirage that there aren‘t any fails, or are many fewer than appears. Wall Street benefits from a service that automatically resubmits settlement failures, what the DTCC calls “fail transactions.” Many trades that fail to settle are required to be re-submitted, where they receive new settlement dates, in essence, erasing the fail to deliver by creating a new record. When this happens, the records show that the fail transactions are no longer outstanding; the next day begins with zero fails.

Trimbath said, “I want to know who is failing to deliver, I want to know the names of the brokers who victimized public companies, so I can avoid doing business with them.”

She asks why NSCC does not throw out the members who fail to deliver shares for settlement. Congress gave them the authority.

Who controls the DTCC

The answer is that the banks and brokers who use DTCC‘s services, who process trades there, who fail to deliver there, are insiders who sit on the DTCC Board of Directors. And the feeble SEC, dominated by the industry it is supposed to regulate, fails to require the DTCC to impose sanctions on errant members.

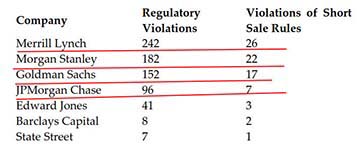

In 2007, seven companies with 18 employees sitting on the Board of Directors at DTCC and its subsidiaries, and on the NYSE and other self-regulatory organizations, had 728 securities rules violations in one year, including 84 violations for rules governing short sales.

The alleged perpetrators were in charge of the organizations that write and enforce the rules.

What does the U.S. Congress do?

Trimbath writes that according to a 2012 documentary, “The Wall Street Conspiracy,” former California State Senator John Harmer, a Republican, brought the issue to the U.S. Senate Banking Committee in 2005. U.S. Senator Robert Bennett (R-Utah) got involved with the problem, because naked short selling had attacked Utah-based Overstock.com.

Bennett began drafting legislation. Senator Shelby (R-Ala) and a few other Banking Committee members were interested in holding open hearings with investors and entrepreneurs. The hearings did not happen.

Harmer said in the film that the DTCC sabotaged their efforts. And that SEC chair William Donaldson also opposed them. Harmer said, To him, the whole business of trading securities belongs to the major brokers, they are the ones who are running this, and you folks down in Washington should not meddle in this or you‘re going to upset the apple cart.

According to Harmer, They also got to Chairman Shelby. And so, Shelby said to Bennett — I think we oughta wait and give the SEC a chance to come in and explain their position. And so, we were simply the victims of a very effectively executed strategy to make sure that there were no hearings on this, and even to make sure that Senator Bennett did not introduce the bill.

A story in The Washington Post in 2012 helped explain the lack of enthusiasm in Congress for reforming the processes that lead to phantom shares. “In 2008, for instance, 17 lawmakers reported investing hundreds of thousands of dollars in short-selling funds,” including bets against U.S. Treasury bonds, the Dow Jones Industrial Average and the S&P 500.

The SEC‘s “reforms” had little effect. Compared to $6 billion in daily fails in 2003, the number was $7.4 billion for February 2020.

Trimbath considers solutions

Trimbath said that investors who want to avoid being “UnShareholders” should have shares registered in their names. They can do that, even without holding a certificate, through direct purchase and registration programs offered by many issuers.

Her alternatives for actions by the key actors, the DTCC and SEC, are these:

Reveal the names of the failing brokers so that investors have complete information when they make the decision to select a dealer, a local dealer or a big bank/broker-dealer. She said, “NSCC and the brokers must have records of who sold what and which of those did not deliver. If they do not, then this is a much bigger problem than any of us ever imagined.”

Throw the failing brokers out. Congressional law tells the central clearing organization that they can refuse membership (in the DTCC) to brokers that fail to deliver for settlement.

Do buy-ins. Allow the NSCC or DTC to buy-in member positions or impose stiff fines for fails to deliver. Buy-ins means allowing the party that did not receive shares to purchase them on the open market and charge the cost back to the party that failed to deliver. She said they have not worked. For stocks where there are already a high number of fails, the buy-in trade usually fails to settle, too. Brokers have sold shares that never existed. Where will they get them now?

Reverse the trades. Require that sold shares be delivered or reverse the trade. She called that the more efficient solution. Reverse the trade and return the original payment with a use-of-funds compensation set at a real risk level. For the investor who bought shares they did not receive, it is as if they loaned free money to the broker.

Do not expect the DTCC or SEC to adopt any of these reforms. Trimbath has appeared at conferences and meetings to discuss the issues she raises. She said DTCC frequently attempted to silence her. She learned that in one case, a conference organizer laughed off an attempt by a DTCC official to get her thrown out as keynote speaker.

“Naked, Short and Greedy” by Susanne Trimbath, Spiramus Press, (London). January 2020.

Susanne Trimbath is founder of STP Advisory Services and a business instructor at Cochise College in Sierra Vista, AZ. Dr. Trimbath started her training in finance and economics at the Federal Reserve Bank of San Francisco. She worked in operations at depository trust and clearing corporations in San Francisco and New York, including Depository Trust Company, a subsidiary of DTCC. She has a doctorate in economics from New York University‘s Graduate School of Arts and Sciences. She taught economics and finance at New York University and the University of Southern California Marshall School of Business. @susannetrimbath

Hello,

I am a shareholder with CMKM Diamonds. As you know, we were naked shorted into the trillions. Please let me know what to expect today. Re: RICO / Settlement

THANK YOU VERY MUCH, please email me.

MICHAEL

Any insight / advice on worries that I am an “unshareholder” of GME?!

LK: Ask your broker for a stock certificate.

Pingback: GME – EndGame part 6: The Big Reset, or The Greatest Financial Crime of the Century – and how to play GME going forward via /r/wallstreetbets #stocks #wallstreetbets #investing – Wall Street Bets 101

Pingback: GME - EndGame half 6: The Massive Reset, or The Biggest - CoBlog

Pingback: GME – EndGame part 6: The Big Reset, or The Greatest Financial Crime of the Century – and how to play GME going forward – WallStreetBets

Pingback: GME – EndGame part 6: The Big Reset, or The Greatest Financial Crime of the Century – and how to play GME going forward via /r/wallstreetbets – Wall Street Bets 101

Pingback: Interplay of Relationships between Goldman Sachs, Robinhood, Melvin, Gee Em Ee and DTCC via /r/wallstreetbets #stocks #wallstreetbets #investing – Wall Street Bets 101

SAME THING HAPPENING NOW TO CLOVIS ONCOLOGY ( CLVS). 45% short float and still being shorted!

“…buy stocks, pocket the money and fail to deliver…”

*sell* stock

Pingback: Superstonk Daily DD- Friday 05-14-2021- LEGENDARY LUCY KOMISAR AMA TODAY!!! ALSO... IT'S CUSTOM FLAIR FRIDAY!!! ✅ - Alex Coleman Kime

Pingback: Chatter #158 - Dr Susanne Trimbath on GameStop, Failure To Delivers, and Naked Short Selling - The Jist

Pingback: АДМИНИСТРИРОВАНИЕ: Chatter #158 - Dr Susanne Trimbath on GameStop, Failure To Delivers, and Naked Short Selling 2021 - DeveloperClub

Pingback: Special Solari Report: Game Stop & Naked Short Selling with Lucy Komisar – The Komisar Scoop

Pingback: Special Solari Report: GameStop & Naked Short Selling with Lucy Komisar – The Komisar Scoop

Pingback: Computershare And DRS: The Only Way To MOASS

Pingback: ComputerShare and DRS is the way. It ignites the squeeze because it's equivalent to an investor-driven share recall. You aren't transferring shares, you are transferring CERTIFICATE ownership away from the DTC and into retail's hands. Shares can be replicated infinitely. Certificates can NOT. - Retail Investor Blog

Pingback: There’s some confusion of DRS versus DSPP. Both accomplish the same thing of registering shares in your name and locking the float. DRS is for shares you’ve already purchased which are held in a brokerage account. DSPP is for completely new shares you want to purchase through ComputerShare. on CFD – at September 30, 2021 at 09:19PM – Dave's Finance Ramblings

Pingback: This needs to be said – and is a tough pill to swallow. Buy and hold is not guaranteed to cause MOASS nor is a market crash. Apes can beneficially own hundreds of multiples of the float, but beneficial ownership of the float does absolutely nothing to their ability to short the stock and reset FTDs. on CFD – at October 10, 2021 at 05:06AM – Dave's Finance Ramblings

Pingback: This needs to be said – and is a tough pill to swallow. Buy and hold is not guaranteed to cause MOASS nor is a market crash. Apes can beneficially own hundreds of multiples of the float, but beneficial ownership of the float does absolutely nothing to their ability to short the stock and reset FTDs. on CFD – at October 10, 2021 at 11:42AM – Dave's Finance Ramblings

Pingback: This is how you do real DD on CFD – at October 11, 2021 at 02:50AM – Dave's Finance Ramblings

Pingback: The DTCC – Naked Shorts, Swaps, ETF’s & Role in Current Markets – Retail Whale Street

This research based journalism is EXACTLY why i direct register my shares with the company’s own transfer agent. My granddad always advised me to do the same. No question about if I truly own my stock.. and my voting materials come straight from the company, not some unsupervised, under regulated broker.