Switzerland is a tax haven for corporate and private tax cheats and a legal safe harbor for criminals, but hell for whistleblowers

Introduction by Lucy Komisar

July 29, 2020

Swiss whistleblower Rudolf Elmer tells the story of his 15-year legal battle against Swiss judges and prosecutors and the Swiss bank Julius Baer over their charges that he violated Swiss bank secrecy. This month, he filed a complaint of bias against the president of the Swiss Criminal Law Department, which has dragged out the case as deliberate harassment and has collaborated with the bank which, evidence shows, was engaged in massive financial corruption, tax evasion and money laundering for itself and for clients. All while ignoring rulings that Swiss secrecy law didn‘t apply.

And on July 27th, Michael Lauber, the chief prosecutor handling Elmer‘s case, facing impeachment, resigned after the supervisory body that oversees him said he had “seriously violated his official and legal duties”, and through his conduct he had “damaged the reputation of the Office of the Federal Prosecutor of Switzerland.” Elmer backs that up with details below.

There have been two European documentaries about his case, trailers at the end. Here‘s a brief Deutsche Welle video clip so you can meet him. Then to his story. (Article in French and German.) Note that some of the links have strike-throughs but they work.

By Rudolf Elmer

Zurich, July 29, 2020

I was the chief operating officer who from 1994 till 2003 oversaw the Cayman Islands subsidiary of Julius Baer, a private Swiss bank. I was fired by the bank, and I subsequently provided to American, Swiss, German, Belgian, and Brazilian authorities‘ records from the offshore-bank subsidiary that detailed evidence of massive money laundering and tax evasion involving billions of dollars.

It included big hedge and private equity funds faking trades from Cayman when they really occurred at trading desks in Europe and New York, depriving countries there of millions in taxes.

It included the trust of Mexican General Arturo Acosta Chaparro, imprisoned in 2000 for having ties to the Ju¡rez drug cartel. A note in his file: “We cannot call the client in his home country.”

Such disclosures failed to prompt Swiss authorities to act.

At about that time, the Swiss Federal Tax Authority, which I had already informed in 2004, knowing that prosecutor had confiscated data of Julius Baer, sent a request to the prosecutor‘s office asking for mutual assistance. Only in March 2006, did office say it would not make a decision on the request and referred the case to Zurich`s Tax Commission II, a political body.

By then, I had accused Julius Baer of tax evasion, money-laundering, coercion, stalking my family by the private detectives of Julius Baer and emails with death threats such as “Rudy, if you talk about Julius Baer business, we are going to kill your daughter.”

I went to the Swiss media with my story, and still there was no action.

Retaliation

But there was retaliation. I was arrested in 2005 on charges that I violated Swiss bank and business secrecy laws. I was accused of attempting to coerce Julius Baer officials by threatening to release details on the Cayman Islands offshore accounts. I spent 30 days in prison solitary confinement, then was released with the charges pending.

However, the evidence I had was damning. In February 2006, Julius Baer Group General Counsel Christoph Hiestand approached me and my lawyer to offer for my silence $400,000 and withdrawal of all complaints against me. The bank would arrange for the prosecutor to shelve the case. I turned down the offer, because it would have meant to be silent for the rest of my life. I have never made deals with criminals.

In 2008, from about January to October, hoping to draw international attention to the still-pending legal case and the abuses of the offshore-banking system, I released a small portion of the Julius Baer bank data to the public via Wikileaks. Julius Baer responded with a motion in U.S. court asking for an injunction to force Wikileaks to shut down its U.S.-hosted website.

The American judge initially granted the bank‘s request, which generated a storm of media coverage and outrage from free-speech and civil liberties groups. In the wake of that blowback, the judge reconsidered and reversed the injunction against Wikileaks.

Meanwhile, the Zurich Tax Authority ruled Sept 28th, 2006 that the Swiss Federal Tax Authority and other tax authorities could not investigate the data on grounds I violated Swiss bank and business secrecy and had stolen data I was not legally entitled to have. It was a way that when other countries‘ tax authorities approached Switzerland for mutual assistance on tax matters related to JB, the Swiss answer would have been the data was stolen we cannot cooperate and give mutual assistance (providing the data).

In legal terms the data was a poisoned fruit could not be used in any court trial. That was proved false since as chief operating officer and compliance officer, I was entitled to have the data. It was a political decision of Zurich‘s Tax Authority to protect Julius Baer Zurich.

If the German tax authorities had approached Switzerland for Mutual Assistance on Tax Matters related to JB the Swiss answer would have been the data was stolen we cannot cooperate and give mutual assistance (providing the data). In legal terms the data is a kind of poisoned fruit qualified the Zurich`s Tax Commission II and therefore the data cannot be used in any court trial.

One needs to know that Swiss tax policy is managed out of Zurich, the base of the most important Swiss tax and legal experts, who determine what happens in the Swiss Federal Tax Authority.

Based on Wikileaks published information, the Guardian UK published two major reports on the banking data. These reports gave me international credibility. For many people, I was no longer a vengeful banker who claimed to have been unfairly dismissed. I was a truth teller.

The evidence of the corruption

The Guardian reported:

- “Some documents refer to a Greek shipowner who placed $26.5m into a trust. Payments appear to be being made in and out without the knowledge of the trustees. The shipowner is said to have written letters referring to the trust as though it were a personal bank account. The trust appears to be funding the settler’s [founder’s] shipping business, said one memo. Another speaks of a risk that the structure could be regarded as a sham.

- A memo by one Caymans financier, who did not leave a message on the answer machine of a UK client in case the tapes are seized by the authorities.

- A memo about the affairs of a UK stockbroker whose trust was bluntly said to contain undeclared money.

- Fears among Julius Baer staff that we are rubber-stamping investment instructions in relation to trusts set up by a London-based South American financier.

- Suspicions a German businessman sold a yacht which belonged to his trust and pocketed some of the cash for himself.

- One file supplied to U.S. authorities‘ records concerns over a trust called Moonstone, opened on the instructions of the law firm of Dr Thomas Baer, former president of the Julius Baer bank, in the name of a man named Schuler. Cayman staff did not have a passport for Schuler and no way of knowing who he was. Nor were they able to verify where the money had come from. Dr Baer said he could not discuss a case where documents might have been supplied by a criminal source and that he was bound by lawyer’s confidentiality.

Investigative journalist Gian Trepp wrote about this in 2006 in the independent newspaper Wochenzeitung, independent because it doesn’t belong to a political party, an association or a media company.

His story involved Dr. Pietro Supino, who worked at the time for Julius Baer‘s law firm Baer & Karrer and was the strawman settlor of the trust. (Settlor is the person who settles property on a trust.)

Supino, by then president of Tamedia, the second largest Swiss media group, wrote a statement published in Wochenzeitung saying that as an employee of the law firm, he only executed the instructions of Dr. Baer related to the Moonstone Trust. He and Dr. Jan Belinski, spokesman for the Julius Baer family, tried to get Trepp to withdraw the article, arguing that I was a criminal and he could not rely on my data, but he refused. Trepp told me he felt the article was correct and as an independent journalist he would not do what the powerful wanted him to do.

- I also had more copies of written notes on clients‘ documents that made it clear the bankers knew they were aiding illegal acts.

- Ken Richardson (jailed in the UK for arson): Trust should be treated for U.S. tax purposes only as owned by another person.

- “The Trust of Arturo Acosta Chaparro; “We cannot call the client in his home country.” Acosta was a Mexican Army general accused of responsibility for hundreds of disappearances during Mexico’s 1970s dirty war.” He was imprisoned in 2000 for having ties to the Juarez drug cartel but released in 2007 for lack of evidence. He was shot dead in 2012.

- Client Richard Kimber, a UK stockbroker, whose trust was said to contain undeclared money. He was subsequently accused by the High Court of using trusts to steal money from his wife.

- Ken Richardson: “Do not leave any message on the answering machine of UK client in case the tapes are seized by the authorities.” Richardson was subsequently jailed for arson.

- And commonly: “We cannot add this asset to the trust otherwise U.S. authorities would find out about the trust.

- “We have to back date the loan in order to not get into problems.

- And a political connection: Senator Roseana Sarney Trust belonged to a member of the Brazilian senate, daughter of a former president, and a hot tip to become president herself in the 2002 elections until she was forced to step down in a corruption scandal after the Wikileaks exposure led to a police raid on her home the found US $500,000 in unexplained cash.

I felt it was time to file a complaint with the Federal Prosecution Office. On February 6, 2009, I filed a criminal complaint against Bank Julius Baer with the office of Swiss Federal Attorney Michael Lauber (All for One) including 170 gigabytes of data of Julius Baer‘s corrupt dealings. I said I was strongly convinced that there was sufficient suspicion of a crime. Swiss law requires prosecutors to investigate such cases.

On February 20, 2009, I received a one-page letter from the deputy of the Office of the Swiss Attorney General, Ruedi Montenari stating that charges would not be pursued.

Fortunately, I had the right to access all court files and found the 4-page letter sent to Zurich`s Prosecution Office and Bank Julius Baer by the Swiss Attorney General’s Office!

It mentioned the Carlyle Group, David Radler, Arturo Acosta Chaparro, Roseana Sarney, Ken Richardson and others, and claimed that none of them had any connection to Switzerland and that I allegedly did not argue in enough detail in my 21-page complaint. I was not invited to the office of the Swiss Attorney General to explain the data. The crimes were public in the Guardian UK`s reports and on WikiLeaks. In addition to those described above:

- Carlyle placed in Julius Baer, Cayman, $10 million for Sultan Khalid bin Mahfouz, a Saudi banker who was indicted for fraud in the collapse of the Bank of Commerce and Credit International, and $2 million for Akram Ojjeh, who earned a fortune brokering arm deals in the Middle East.

Julius Baer Trust Cayman was the trustee of Carapace Ltd, owned by David Radler, the long-term business partner of the disgraced newspaper proprietor Conrad Black. Radler and Black, Canadians, were imprisoned for stealing millions of dollars from their shareholders.

Still, Swiss newspapers and television refused to publish evidence I had showing Julius Baer`s facilitation of international crime. They preferred to show me as a data thief, fraudster, mentally ill person, terrorist, neo-Nazi etc., to protect Julius Baer and the Swiss financial center.

Solitary confinement and bank‘s death threats

My legal odyssey in the Swiss court system was on its way. It included spending at various times some seven months in prison, all in solitary confinement, and enduring harassment and persecution by Swiss authorities. The Zurich police failed to protect my family from the stalkers.

My problems were exacerbated in January 2011 in my symbolic handover of a CD of Julius Baer bank records to Julian Assange of Wikileaks at London’s Frontline Club, which champions independent journalism and press freedom, to put a spotlight on my first court trial starting in Zurich the same week, January 19, 2011.

Assange told media he had data. In fact, I had provided a CD to a lawyer and associate for them to give Wikileaks and the Tax Justice Network. But when I was sent to prison, they didn‘t hand over the data.

However, I was found guilty of having violated Swiss bank secrecy and was put in prison the same day for 187 days. They had to release me because six months was the maximum penalty at that time. In 2010 it was increased to three years and later to five.

Finally, October 10, 2018, the Federal Supreme Court overturned the court ruling of the Zurich Higher Court in its entirety and sent a notice to the lower court to reassess the case.

However, the lower court (Higher Court of Zurich) of November 29, 2019 said:

1) I sent a threatening email from Serfhaus, Austria, in August 2005 saying I would publish all that data if the bank didn‘t stop stalking.

2) I sent a threatening email from Mauritius in September 2006 to Julius Baer Group General Counsel Hiestand, “I will send an assassin!”

3) I forged a letter to German Chancellor Angela Merkel in September 2007, which the court said was the most serious offence of the three.

That fake document was a letter to the Chancellor to close all accounts with Julius Baer, Zurich and Guernsey saying, “It is not the policy of Bank Julius Baer to hide bank accounts offshore. The last payments in the amount of $1,200,000 were made to numbered accounts at Credit Suisse. These payments are suspicious payments that the bank must report to the authorities.”

The letter was intentionally written with many mistakes, and the bank would never disclose such content to a client in writing. It was a trial balloon to find out if Wikileaks published uncensored information. When it published this, it was clear to me that it was the first medium that did not censor Julius Baer`s data, and I now began to deliver only real data to Wikileaks.

I committed offences 1) and 3). I did not commit offense 2, but the court did not believe me even though I could prove that I was not in Mauritius at the time the email was sent, the email address was not mine, and no IP address was provided as evidence.

Those convictions were my mistake, but after two years of stalking, I suffered from severe post-traumatic stress disorder, which was confirmed in writing to the judges by Dr. Ulrich Schnyder (Director of the University Hospital of the state of Zurich), a leading European expert in research related to posttraumatic stress disorder. I could not help but defend my family and myself with threats.

The threats were that 1) if the stalking of my family does not stop, I will make all the data public, 2) I will provide the data to tax authorities, 3) I will involve the police. I admitted doing this when I was later questioned by the police.

The judges ignored the opinion of Dr. Schnyder. On the two threats (2003 and 2004) and falsifying the Merkel letter (2007), they sentenced me to 14 months imprisonment, reduced to three years‘ probation on condition of not being convicted of other crimes. Somehow, I had to be found guilty so that the judges could silence me for three years. The principle that exonerating and exculpatory circumstances should be determined and included in the verdict was ignored.

Acquitted of violating Swiss banking and business secrecy

But the gag order didn’t occur. After 13 years‘ legal battle, I was finally acquitted of violating Swiss banking and business secrecy by the Swiss Federal Supreme Court.

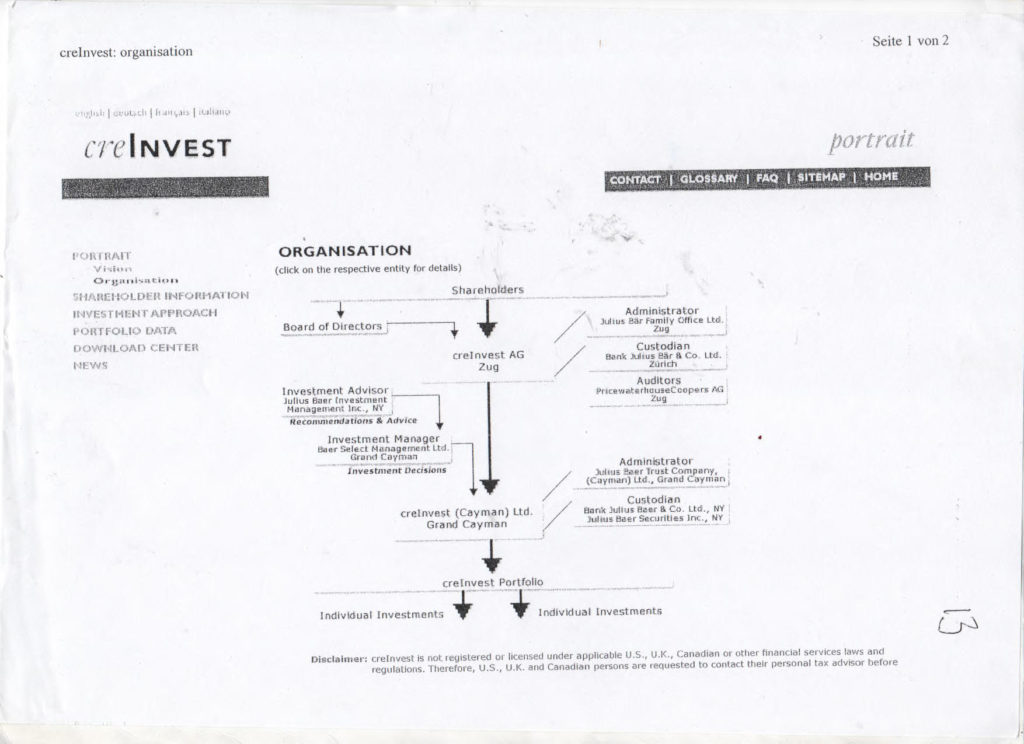

My lawyer and I had insisted to prosecutors and judges since the beginning of the criminal investigation in 2005 that Swiss bank secrecy laws did not apply to me, because I was not employed by the Zurich bank Julius Baer & Co. Ltd., which is regulated by Swiss law, but rather by an associated Cayman Islands company. The data originated from a trust office of the bank, an accounting and management company named Julius Baer Trust Company Ltd. of the Cayman Islands. Thus, it was not protected by Cayman or Swiss banking secrecy.

Only the second opinions of the prominent experts Dr. Thomas Geiser (professor at University St. Gallen and a federal judge) and Dr. Mark Pieth (professor of criminal law at the University of Basel and a prominent anti-corruption expert) made it clear to the judges that there was no way to find me guilty of violating Swiss bank and business secrecy laws.

If the federal judges had confirmed the guilty verdict of the lower court, it would have meant Swiss bank and business secrecy could be applied globally to Swiss subsidiaries and employees who work under local contracts, such as with Bank Julius Baer Ltd., New York.

Without the opinions of the two Swiss experts, I would have gone to prison for at least 3 ½ years or even the 5 ½ years that prosecutors initially requested.

Yet, in spite of the baseless charge that started the investigation, I, the victim, was ordered to pay court costs of approximately $350,000 for causing the criminal proceedings! I was not compensated for the 220 days in prison and the ban on being allowed to work in the Swiss financial industry. I have been unemployed in Switzerland since 2005.

Counting up the cost

The outcome of the long legal battle is an unbelievable cost to the taxpayer from a monstrous procedure: 48 interrogations of up to 6 hours, with the presence of defense counsel and prosecutor, 5 judicial coercive measures, 5 public court proceedings, in total 220 days in solitary confinement, 5 house searches, 70 court decisions, a sealing procedure, 6 extensive expert opinions, 7 international requests for legal assistance, over 2,000 pages of court decisions by judges, 150 federal files of documents at the defense counsel, three months in hospital and severe health problems. Plus at least $150 million uncollected Swiss taxes due to Julius Baer‘s use of the Cayman offshore system.

One would think that this is the end of an incredible odyssey in the world of Swiss justice in my home country! No, the story is not over yet.

The sentence is not in force, because as a result of my appeals (March 3, 2020 and July 6, 2020), the case is not yet closed. Only after a final ruling and no legal possibility of appeal will the verdict be in force.

The specific grounds of the initial appeal of March 3, 2020 was foremost that the legal case lasted for 15 years, because Julius Baer & Co., Zurich, filed criminal charges on June 17, 2005, but the public prosecutor’s office and the two lower courts kept making “mistakes.”

For example, no Swiss bank account was mentioned in the indictment. In 2011, the lower court, which had carelessly or deliberately ignored the faulty indictment and ignored court files, found me guilty, but could not prove that I had disclosed information about an account with Bank Julius Baer & Co. Zurich, which would have violated Swiss bank secrecy. Therefore, the indictment had to be redone! As a result, in 2012 the prosecutor‘s office had to conduct the entire criminal investigation again, from the beginning.

It was not until 2016, eleven years after the opening of the criminal proceedings, that the High Court of Zurich was able to rule on the matter. Then it took another 2 3/4 years until the Swiss Federal Supreme Court ruled (see page 46) on October 10, 2018 to overturn the ruling of the High Court, ordering reevaluation. Only on February 2, 2020 did my lawyer and I receive a new judgement of the High Court of Zurich.

The March 3, 2020 appeal, however, was turned down by the decision of June 17, 2020.

On July 6, 2020, I challenged the final June 17, 2020 verdict of the Federal Court of Switzerland and put the spotlight on the President of the Criminal Law Department of the Swiss Federal Court and its court clerk, with a “Request to exclude of the President of the Court and the court clerk in the criminal cases concerning the Swiss Federal Supreme Court Ruling 6B_280/2020 of June 17, 2020” (In English, in German) due to evidence of prejudice and bias.

According to Article 30(1) of the Swiss Federal Constitution and Article 6(1) of the European Court of Human Rights, every person has the right to have his case heard by an impartial judge without interference from extraneous circumstances or prejudice. That guarantee is violated when there is strong appearance of bias or the risk of bias. My complaint shows that the president of the court, Christian Denys, and the court clerk, Dr. Andreas Traub, are biased in my case.

My judicial odyssey of now 15 years is an excruciating, even criminal strategy to plunge me and my family into social, financial, and professional death and show that every whistleblower in Switzerland will be destroyed. Do not dare to become a truth teller, or you will destroy your career. Because reporting a financial crime in Switzerland is itself a crime!

If the authorities who targeted me cared about prosecuting crime, instead of protecting criminals, I could have been a key witness, first and foremost against the Julius Baer Group itself on its use of Cayman as a vehicle to evade and avoid taxes. And then other Swiss citizens and private asset managers who set up Cayman funds for their clients.

How Julius Baer Bank cheated Switzerland of millions

Here is one way Julius Baer Bank & Co. Ltd., Zurich, cheated Switzerland. The bank placed billions of dollars of client money with the Cayman bank, which used the funds to invest in stocks and bonds. The entire portfolio was managed out of Zurich by the Julius Baer Group‘s top three traders.

The Cayman‘s profit, not taxed in Cayman, was then repatriated via dividends to the Swiss holding company, which was tax exempt in Switzerland. This was in violation of the law that taxes have to be paid where the decisions are taken even though the accounting was performed in an offshore center.

Another setup was that a Cayman Management Company made the decisions on the dealings for hedge funds and private equity funds, because if the decisions are taken in Cayman the performance fee of up to 20% is earned offshore tax-free. There were performance fees of several millions of dollars free of taxes. But the Cayman Management Company was a fake investment manager.

I was listed as a hedge fund and private equity manager in Cayman. But, I was an accountant, not a trained trader and was too far away from the marketplace to do real trading. I could not make any buy and sell decisions on those funds, whose net value (assets under management) in the Cayman bank totaled about $6 billion.

Furthermore, if you run a hedge fund, you deal mostly with derivatives, and 200 deals a day via automatic trading is normal. To calculate the risk of the trade, you need a risk management tool such as the Monte Carlo Module, very well-known at the time. It was extremely complex and highly mathematical, I lacked the required mathematical knowledge to use it, plus I did not even have the software!

Hedge and private equity funds were structured out of Switzerland with only accounting performed in the Caymans. Derivative deals supposedly out of Cayman done on the New York, London or even the Swiss stock exchange were all decided and executed by the trading desks in New York, London or Zurich. I simply approved the investments as a director of the hedge fund`s management company. In effect, I was a fake investment manager for hedge and private equity funds. The funds evaded taxes where the trades really occurred.

But instead of being called on to help the system catch major crooks and tax evaders who used Swiss and Cayman bank secrecy, I was prosecuted and initially convicted for violating the same bank secrecy. The decision of the Zurich Tax Commission II that the Cayman data could not be used for criminal prosecution and tax investigations in Switzerland were to protect individuals and organizations taking advantage of the Swiss tax haven system.

As chief operating officer and compliance officer, I was entitled to access and have the data. Therefore, I could not legally have stolen it, which was only later confirmed by Swiss Federal Court ruling of October 10, 2018. As the data was not illegally obtained, it could have been investigated by tax authorities and prosecution offices. If they dared expose Swiss bank corruption.

Swiss justice authorities and real criminals

One has to ask if the Swiss criminal justice system can (or is willing) to enforce the law in cases such as the fraud, embezzlement and money-laundering organized by Gianni Infantino, president of FIFA (the international soccer federation), and the impeachable behavior of Swiss chief prosecutor Michael Lauber who secretly met with Infantino during the investigation, both now the object of criminal complaints.

It raises questions about the so-called summer fairy tale case against the former DFB (German Football Association) presidents Theo Zwanziger and Wolfgang Niersbach, the former DFB general secretary Horst R. Schmidt and, formerly FIFA general secretary, the Swiss Urs Linsi, which shows that no politically significant trial will be completed within the legal timeframe.

DFB organized the football world cup in Germany 2006. The internationally reported trial about dubious payments in the millions prior to the games was to be a prestige case for Swiss investigators, leaving behind a debacle of dirty work and entanglements with FIFA boss Gianni Infantino. The delay of the trial could be seen as aiming to protect certain well-known individuals, but also the reputation of Switzerland. No trial, no problems, no reputational damage. It would have been a nightmare to learn that the FIFA might be a criminal organization!

Banking Corruption – HSBC, Credit Suisse, Cum-Ex

Another striking example of how the powerful are protected in Switzerland is the HSBC deal over money laundering. HSBC paid Geneva authorities 40 million Swiss francs ($43 million) to settle a money laundering investigation at its Swiss private bank. It was not about aiding tax evasion; it was about money-laundering, which is serious offence and often is linked to capital crimes. However, Swiss authorities accepted the money to close an investigation which might have brought to light serious crimes.

Then there is the Geneva-based asset manager, Alain Driancourt, convicted of helping set up offshore companies and accounts at Credit Suisse and EFG International, a private Geneva bank, to mask the origin of the money and ownership of accounts. He received a risible suspended sentence and ultimately paid just $1000 in court costs.

And tax fraud by Cum-Ex, a $60-billion scheme by European banks, stock traders, and lawyers. Germany tried two bankers involved in the fraud and a Basel bank, J. Safra Sarasin. They cooperated and got suspended sentences, with one ordered to pay $16 million to counter his profits, because, the prosecutor said, “the greatest tax robbery in German history was not conducted by two individuals but hundreds of people.” The bank had to pay $56.5 million to a German drugstore chain owner who was a victim of the scam. Because of the statute of limitations, much of the stolen money can never be recovered.

Instead of going after perpetrators, Switzerland tried three whistleblowers – one the lawyer representing the store chain owner — for violating bank secrecy and one also for industrial espionage, which carries a longer sentence!

The three got suspended sentences and are appealing. Suspended because it is a first-time conviction and not a capital crime. On the other hand, the court needed a sentence, because otherwise huge compensations could be claimed by the three, including by one whistleblower kept in solitary confinement for four months.

In a judicial culture that protects banks, Swiss prosecutors started no investigation of the J. Safra Sarasin bank. One of the whistleblowers said he would appeal.

They moved slowly on payoffs by Petrobras (the Brazilian oil and gas corporation). The Swiss Federal Prosecution Office started investigations in 2015 when the scandal was revealed and only recently (end of 2019) did the Federal Prosecutor filed an indictment.

There is still no court trial on the way and one wonders why searches in the two unidentified Swiss financial institutions said to be involved were not performed. Based on a press release by FINMA, the Swiss Financial Market Supervisory Authority, one would be Julius Baer. In February, FINMA announced, under the headline “Serious AML failings at Julius Baer,”

“The Swiss Financial Market Supervisory Authority FINMA has found that Julius Baer fell significantly short in combating money laundering between 2009 and early 2018. The shortcomings arose in connection with alleged cases of corruption linked to PDVSA, an oil company, and FIFA, the world soccer federation, resulting in enforcement proceedings on the part of FINMA, which have now concluded.

FINMA has instructed Julius Baer to undertake effective measures to comply with its legal obligations in combating money laundering and rapidly finalize the measures it has already started putting in place.

Moreover, Julius Baer must change the way it recruits and manages client advisers as well as adjusting remuneration and disciplinary policies. The Board of Directors must also give greater attention to its AML responsibilities. Furthermore, Julius Baer is prohibited from conducting large and complex acquisitions until it once again fully complies with the law. Lastly, FINMA will appoint an independent auditor to monitor implementation of the above-mentioned measures.”

Switzerland accepted a request from the Brazilian and Portuguese authorities to handle the case in order to avoid multiple parallel investigations. The Swiss authorities looked into more than 1,000 bank accounts at more than 40 Swiss banks over the course of the investigation into the scandal, which included bribery payments of $1 billion sent to Swiss bank accounts.

The banks that allegedly were used included Julius Baer, Credit Suisse, Union Bancaire Privée, Lombard Odier, Pictet and others. So far 60 criminal proceedings are pending at the Swiss Attorney General‘s Office in connection to the Petrobras affair, including two against Swiss financial institutions.

Switzerland is under enormous international pressure in this case. However, because searches of major Swiss banks are non-starters, I suspect few of the pending proceedings involving them will end in a courtroom. They could end with an agreement to accept a suspended sentence and pay a penalty. Then the crime is not made public and the case is quickly closed.

[Julius Baer settled with the U.S. Justice Department for $80 million and a three-year deferred prosecution agreement in November 2020.]

Looking at all these cases, it appears that the Department of Penal Law of the Swiss Federal Court, the Swiss Attorney General`s Office and Swiss authorities e.g. Zurich`s Tax Commission II are more about stretching and bending the law in favor of the accused and powerful in order to make Switzerland ultimately attractive not only as a tax haven but also a legal safe harbor for criminals.

Human Rights Watch with Baer official on its board ignores case

During these difficult times in Switzerland, I have had no support from Swiss civil organizations such as Swiss Victim Support, not even to protect my family, especially my daughter who was six years old at the time the case started. Human Rights Watch, Switzerland, where Dr. Raymond Baer, Honorary President of Julius Baer Group, was on the advisory board, did not support me.

Therefore, in 2006 I had to leave Switzerland for Mauritius to give my family a better place to live and to protect us from stalkers. At the beginning of my fight, I had only the support of the Tax Justice Network, London, my American lawyer Jack A. Blum, UK whistleblower Martin Woods and the independent Swiss investigative journalist Gian Trepp, who reported my case in 2006 in the newspaper Wochenzeitung.

For more detail, for legal wonks, here are key elements of the appeal (English, German) to the Federal Supreme Court of Switzerland July 6, 2020

The appeal deals with the president of the Criminal Law Department and federal judge Christian Denys and his court clerk Dr. Andreas Traub. The complaint is

– regarding the following grounds for recusal (Federal Law of the Swiss Supreme Court with the BGG Art.34 article. 1, a and e) and the objective appearance of a suspicion of bias and impartiality of Judge Denys and Court Clerk Traub with regard to the assessment of the complaint of March 3, 2020 filed by complainant in the matter of the Swiss Federal Supreme Court decision of June 17, 2020 (6B_280/2020)

– on the principle that, according to Article 30(1) of the Swiss Federal Constitution and Article 6(1) of the ECHR, every person has the right to have his case heard by an impartial judge without interference from extraneous circumstances or prejudice,

– concerning the fact that the guarantee of the constitutional judge is violated when, in the case of objective considerations, circumstances exist which may give rise to the objective appearance of bias or the risk of bias.

The most important part of the current appeal is a call for a stay of execution on the part of Judge Denys and Clerk Traub with respect to the appeal lodged with the Swiss Federal Supreme Court on March 3, 2020 and its court ruling of June 17, 2020 (6B_280/2020. Secondarily, the Request of exclusion of Judge Denys and Clerk Traub with respect to the appeal of March 3, 2020 related to the ruling of the Swiss Federal Supreme Court of June 17, 2020 (6B_280/2020, which requires the relevant ruling, due to existing prejudice and bias, to be reassessed by independent judges.

a) The composition of the panel for the above judgment was not discernible to me prior to the Swiss Federal Court’s judgment, since the criminal law department of the Swiss Federal Court does not in principle disclose the composition of the panel of the judges until the judgment is rendered or provided in writing, which is why the complaint is directed only against the president of the Criminal Court and the clerk of the court.

b) The judgment was delivered by post to the complainant on July 1, 2020. The present appeal was filed within the time limit immediately after receipt of the Swiss Federal Supreme Court ruling of June 17, 2020 (6B_280/2020) after learning the identities of the three members of the panel. Pursuant to Court Ruling 1B_542/2018 article. 3.1., an application submitted six to seven days after the reason for the exclusion of court members becomes known is deemed to be in due time.

c) On the judgment of October 10, 2018 (6B_1314/2016 and 6B_1318/2016)

For example, a manifest error of assessment, which was not corrected during the trial, was that the data would come from a Caribbean bank i.e. Julius Baer Bank and Trust Company Ltd, Cayman Islands. Since the beginning of the investigation and proceedings June 17, 2005, I have corrected this false statement several times in the prosecutor’s inquiries and in courts. The data originated from an accounting and management company registered as a trust company, Julius Baer Trust Company Ltd. of the Cayman Islands, not from a bank. Thus, this data was not protected by Cayman or by Swiss banking secrecy law.

The description of the facts in the court ruling of October 10, 2018 (6B_1314/2016 and 6B_1318/2016, (page 4, A. Facts) is therefore again incorrect and misleading. After 14 years of investigation, the economic facts were still not correctly recorded in the Swiss Federal Court ruling of October 10, 2018 (6B_1314/2016 and 6B_1318/2016. Taking into account further errors noted in the court ruling of October 10, 2018, the objective appearance of continuing bias and prejudice by the court clerk cannot be ruled out.

d) I have great interest in bringing these unspeakable criminal proceedings to a final end, but this is not under my control. The detailed appeal of March 3, 2020 shows in an exemplary manner that the opaque and careless way in which the responsible persons have delayed the tedious process considerably, making it extremely difficult to bring the proceedings to a proper close according to the law.

With regard to the appeal of March 3, 2020 and the Swiss Federal Supreme Court decision 6B_280/2020 of June 17, 2020, I therefore submit the following requests:

1. Judge Denys and Clerk Traub must, on the basis of the infringement of Article 30(1) of the Swiss Federal Constitution and Article 6(1) of the ECHR and Article 34(1)(a) and (e) and the fact that, on objective consideration of the circumstances and facts, admit there appears to be prejudice and bias, for the purposes of the assessment of the appeal of March 3, 2020, as persons who have not been lawfully in the functions of president of the court (head judge) and court clerk. Therefore, a review of the ruling of June 17, 2020 should be mandatory and possibly retroactively adjusted.

They should have known after five verdicts against me in previous trials that they could be considered biased and prejudiced. Both also are responsible for the length of the legal proceedings at the Federal Court of 3 1/2 years. Usually, it is 3 to 4 months and in complex cases a bit longer, but not 3 1/2 years! My case is definitely not a complex case, it was made complex due to incompetence and revenge! Plus, there was already a legal case opened in Cayman in 2004, and therefore under international law Switzerland cannot open another one for the same crime. Switzerland could have offered to provide assistance to the Cayman courts. The Cayman case was closed in 2007.

2. The Swiss Federal Court of Justice’s judgment of June 17, 2020 (6B_280/2020) should be invalidated and properly reassessed by impartial and unbiased judges, those whose duties are formerly segregated from this department of the criminal court, in particular with respect to the overall duration and delays during the 15 years these legal proceedings have taken.

3. If requests 1 and 2 are accepted, I should be permitted, within a given period of time, to update and re-submit the complaint of March 20, 2020, in particular with regard to the legal proceedings‘ excessive length of more than 15 years.

4. The appeal should be granted suspensive effect within the meaning of Art. 103(3) BGG*, because in view of the overall length of the proceedings, these requests and the exclusion of court members must be decided before the pending appeal of March 3, 2020 can be reassessed. (Suspensive effect means the case remains open and the verdict is not in force or enforced.) The determination of the duration of the proceedings is therefore still open, though it has already been at least 15 years, which would be assessed by the Swiss Federal Supreme Court in other cases as excessive and unlawful.

*Bundesgesetz über Bundesgericht (BGG) translates to Federal Law on the Swiss Federal Supreme Court, dated June 17, 2005 (as of January 1, 2019)

Additional case history and arguments

1. The Criminal Law Department bears, in addition to the Zurich High Court (ZHC) and the Zurich Attorney General’s Office (ZAGO), a large and direct responsibility for massive procedural shortcomings and the grossly excessive duration of proceedings for the transactions in the legal cases 6B_1314/2016, 6B_1318/2016. This includes, among other things, the acceptance from ZAGO of an excessively long-winded, drawn out and repetitious 95-page complaint without any legal substance.

This observation was made by the recognized Swiss experts Federal Judge Dr. Thomas Geiser and internationally recognized Dr. Mark Pieth.

The ZAGO’s appeal was sharply criticized (and also indirectly the Criminal Law Department of the Federal Supreme Court), because it lacked credible substance related to legal requirements and criminal law in its appeal. In three expert opinions, the two experts stated that ZAGO had not taken into account the principle of Art. 1 of the Swiss Penal Code and had thus ignored one of the most fundamental principles of Swiss criminal law. The 95-page appeal contained only sociological, legal-political, and economic considerations whereas arguments relevant to criminal law were completely omitted.

Furthermore, a change in the law would be required in order to condemn me or to grant extension to the administration of interests of the Swiss holding companies to the Cayman Islands.

2. Such fundamental and obvious violations as well as the excessively long, rambling and lengthy complaint should not have been tolerated, accepted or allowed to be presented by Judge Denys. The ZAGO`s complaint should have been immediately rejected for abridgment and legal revision, which would have massively shortened the duration of the legal proceedings at the Federal Court of Switzerland and saved the taxpayers great expense.

3. Even if the inadequate indictment and complaint of ZAGO were already the main cause of an untenable delay and attorney and procedural costs, the Swiss federal judges should have recognized and taken this into account. In addition, the Swiss Federal Supreme Court generally does not allow such appeals according to federal court ruling 2C_204/2015. This indicates that Judge Denys had a clear motive, bias and prejudice. The Criminal Law Department took 3 1/2 years from the date of filing of the ZOGA`s complaint November 21, 2016 to come up with the revised ruling of the case 6B_1314/3016, 6B1318/2016 ending at present with the final ruling 6B_280/2020 of June 17, 2020.

4. The judgment of the Zurich`s Higher Court of November 29, 2019 (SB190092 would in fact have been a final decision if I had not exhausted all national remedies with the appeal of March 3, 2020 and the judgment of 6B_280/2020 of June 17, 2020.

In the judgment of the Zurich`s Higher Court of November 29, 2019 (SB190092) under the heading: It is recognized (pages 38 – 42), however, it states that an appeal can still be lodged with the Federal Court of Switzerland. This expressly confirms that the Higher Court decision of November 29, 2019 had not yet become final. It is also evidenced that to date, no final decisions against the complainant have been taken by the judiciary.

It is incomprehensible that no ZAGO legal document mentions that according to the Swiss Federal Supreme Court decision of October 10, 2018, no previous decision has become final, since the judgement of the Zurich`s High Court of August 16, 2016 had been completely overturned by Swiss Federal Court ruling of October 10, 2018 (page 46) and had been sent back to Zurich`s Higher Court. On April 26, 2019. Zurich`s Higher Court correctly confirmed to me: ‘Accordingly, there are currently no points of judgement that are already legally binding’.

5. This confirms that the overall proceedings 6B_1314/2016 and 6B_1318/2016 combined in the Swiss Federal Supreme Court ruling of October 10, 2018 have not yet been enforced, i.e. there are no final judgment points.

6. On November 21, 2016, my lawyer filed an appeal against the judgment of Zurich‘s Higher Court of August 16, 2016 within the time limit, for which the written Swiss Federal Supreme Court`s ruling October 10, 2018 (6B_1314/2016, 6B_1318/2016), i.e. 2 ü years later, was only available on February 14, 2019. Zurich`s Higher Court did not send its newly drafted judgment of November 29, 2019 to my lawyer until February 3, 2020. My appeal to the Swiss Federal Court of Switzerland is dated March 20, 2020 and was dismissed by the Swiss Federal Supreme Court`s judgment of June 17, 2020. This judgment was received by the complainant by post only on July 1, 2020.

A duration of 3 1/2 years dealing with the matter on the Swiss Federal Supreme Court is an excessively long period to answer a simple legal question as “What qualifies one as a Cayman employee in a Cayman Bank?” and “How is it related to Swiss banking secrecy?” The total duration of this simple legal case of 15 years must be considered as extreme and specifically engineered to cause grief.

7. The excessive delays, taxpayer money and time wasted on unnecessary procedural actions by Judge Denys and Clerk Traub reflects open and blatant prejudice not only towards me, but also total disregard and disrespect to independent third parties and members of the public who knew about this case.

8. As additional justifications for my request for the exclusion of Judge Denys are other Swiss Federal Supreme Court rulings. In particular the Swiss Federal Supreme Court ruling 6B_222/2017 of the Criminal Law Department (non-recovery regarding the suppression of documents, forgery of documents, etc.) against employees of Bank Julius Baer & Co., Zurich.

The accusation was that employees, in response to the order of July 27, 2005 by the Prosecutor’s Office, deliberately suppressed my signed employment contract, indicating my employment by a Cayman and not a Swiss company. Later, this contract justified the acquittal of a violation of Swiss banking secrecy.

The order of the Prosecutor‘s Office was issued on the basis of the criminal charges brought by Bank Julius Baer & Co., Zurich, dated June 17, 2005, against me. Without any independent judge, my appeal and evidence were blatantly omitted by Judge Denys in his judgment 6B 222/2017. Under Swiss law the prosecutor can force a company or a third party to provide certain information.

In my case the Julius Baer bank handed over my social security agreement with Julius Baer, Zurich, but not my signed contract with Julius Baer Bank & Trust Company Ltd, Cayman Islands. The social security agreement was used only by the prosecutor to state I was employed by a Swiss Bank. Worse, the Cayman contract was confiscated during a house search and not put in the court files, an abusive suppression of evidence which the prosecutor had to admit to publicly in an interview and in the courtroom (Sonntagszeitung August 1, 2016, “a judicial scandal,”) only in 2016.

9. In the Swiss Federal Supreme Court ruling 6B_1223/2017 of December 12, 2017 of the Criminal Law Department regarding False Statement (Article 307 of the Criminal Law) of the General Counsel of Julius Baer Holding Ltd. As president of the court and the proceedings, Judge Denys dismissed the complaint. The dismissal referred to the following false statement made by the general counsel of Julius Baer Holding Ltd. – who had been legally responsible for my case at the bank since 2002 – on the occasion of the interrogation by Prosecutor Alexandra Bergmann on August 14, 2008. The general counsel made the following statement in response to the central question on criminal case SB 110200 against the complainant (quotations):

Question: Prosecutor A. Bergmann: ‘To which banking secrecy laws was he [Rudolf Elmer] subject?

Answer: Christoph Hiestand: Certainly, the local, Cayman Islands banking secrecy laws. After all, he was formally employed by the bank and was therefore also subject to Swiss banking secrecy laws.

This testimony was clearly false and should have been struck off accordingly.

However, Judge Denys dismissed my appeal to the Swiss Federal Supreme Court in its judgment 6B_1223/2017 of December 12, 2017. This is yet another decision by Judge Denys which shows bias and prejudice.

10. In a Swiss Federal Supreme Court ruling of March 16, 2015 (6B_193/2015, the Criminal Law Department ruled against me in the matter of satisfaction and arbitrariness with regard to the cancellation of criminal proceedings against my wife for violating Swiss banking secrecy. The claim for compensation of at least CHF 5,000 ($5,000) was ignored by the courts, even though, among other things, our daughter, who was 11 years old at the time, needed treatment — she later attempted suicide — and my wife needed legal support. The president of the court again, was Judge Denys.

11. With the Swiss Federal Court order of January 19, 2017 (6B_1318/2016, the Criminal Law Department decided to reject the application in the matter of Assessment of punishment (attempted coercion etc.); surrender of confiscated objects; arbitrariness; application for free administration of justice and legal assistance. Among other things, family pictures, objects belonging to my daughter, including children’s stories she wrote, have still not been returned by the authorities. The president of the court again was Judge Denys.

12. It must therefore be assumed without doubt that in the proceedings 6B_280/2020, the panel consisted only of federal judges of the criminal law department who did not comply with the basic legal requirement of the duties of impartial judges, and thus the guarantee of an independent and impartial court hearing from Art. 30 para. 1 of the Swiss Federal Constitution was not observed (Federal Ruling 5A_374/2012 and August 16, 2012 E. 2.1.; 5A_654/2010 of September 30, 2011 E.1).

Switzerland: legal safe harbor for criminals, jail time for whistleblowers

1) The law (tax, criminal and civil law) in general is lax and business friendly (e.g. FIFA is not a public limited company, but only an association under Swiss law that enjoys considerable legal and tax advantages in Zurich).

2) Case law is business-friendly (e.g. modest fines: Alain Driancourt who set up offshore companies to carry out Nigerian officials‘ bribery scheme), and short statutes of limitations. The asset management company, Driancourt & Cie, was ordered dissolved by Swiss authorities for its insufficient controls in view of the risks of corruption in Nigeria. [Collusion in bribery = insufficient controls! Corruption in Nigeria, not in Switzerland!] Driancourt was banned from practicing as a financial intermediary in Switzerland. No jail time, not even a fine except CH1000 ($1065) for procedural expenses.

3) Violation of banking secrecy e.g. today maximum penalty five years in prison, violation of business secrecy three years, industrial espionage up to five years, as in the case of HSBC whistleblower Hervé Falciani.

4) No whistleblower law, all whistleblowers are sentenced (e.g. Falciani five years imprisonment for industrial espionage)

Cum-Ex Scandal whistleblowers applauded in Germany, were tried in Switzerland for violating banking secrecy and got suspended sentences in Switzerland.

5) Weak federal prosecutor (Michael Lauber, but his predecessor also had to be dismissed)

6) Mild penalties imposed on bankers or even the deal made to accuses HSBC of “deficiencies in the fight against money-laundering,” fine $43 million, but nothing about helping its clients conceal millions of dollars of assets from taxes.

6) Swiss financial market supervision of banks is by self-regulation (FINMA), not official authority.

7) Criminal proceedings against powerful people are deliberately delayed to give them a pass under the statute of limitations (FIFA).

Trailers for documentaries

“Offshore: Elmer and Swiss Bank Secrecy”

RudolfElmer.com

Twitter @SwissWB

Facebook.com/swiss.whistleblower

Lieber Rudolf Elmer

Wie ich schon in den 80-er Jahren des letzten Jahrhunderts nachgewiesen habe, zí¤hlt die Vermarktung der westlichen Lí¤nder – inkl. die Schweiz – zum wohl gelungensten Betrug der Menschheitsgeschichte.

http://edmund.ch/m0.html

http://edmund.ch/more/1/ceterum-censeo.pdf

Alle Deine wohl begrí¼ndeten Argumente fíördern gleicherweise den erdrí¼ckenden Beweis dieser Feststellung zu Tage.

In diesem Sinne sind alle Gerichtsentscheide der Schweiz – welches Land ich nur noch als plutokratischen Schurkenstaat apostrophiere – logischerweise ungí¼ltig und unbeachtlich.

Fí¼r Dich heisst das, dass Du Dich durch kein einziges gegen Dich ausgesprochenes Urteil betroffen fí¼hlen musst.

Im Gegenteil! Du kannst davon ausgehen, dass sich alle diese Lakaien des plutokratischen Schurkenstaates schon jetzt und garantiert auch im Urteil der Geschichte fí¼rchterlich blamieren.

Keep cool!

Herzlich

Edmund Schíönenberger

Rechtsanwalt

***********************************

Dear Rudolf Elmer

As I already proved in the 80s of the last century, the marketing of Western countries – including Switzerland – is probably one of the most successful frauds in the history of mankind.

http://edmund.ch/m0.html

http://edmund.ch/more/1/ceterum-censeo.pdf

All of your well-founded arguments likewise bring to light the overwhelming evidence of this statement.

In this sense, all court decisions of Switzerland – which country I apostrophize only as a plutocratic rogue state – are logically invalid and irrelevant.

For you this means that you do not have to feel affected by a single judgement pronounced against you.

On the contrary! You can assume that all these lackeys of the plutocratic rogue state are already now and guaranteed to embarrass themselves terribly in the judgment of history.

Keep cool!

Cordially

Edmund Schíönenberger

Attorney at law

Da fehlte noch ein entscheidendes Wíörtchen:

Wie ich schon in den 80-er Jahren des letzten Jahrhunderts nachgewiesen habe, zí¤hlt die Vermarktung der westlichen Lí¤nder – inkl. die Schweiz – als VOLKSHERRSCHAFTEN zum wohl gelungensten Betrug der Menschheitsgeschichte.

one important word was missing:

As I already proved in the 80s of the last century, the marketing of Western countries – including Switzerland – as DEMOCRACIES is probably one of the most successful frauds in the history of mankind.

Edmund Schíönenberger

Barrister at law

Lieber Rudolf Elmer

Wie ich schon in den 80-er Jahren des letzten Jahrhunderts nachgewiesen habe, zí¤hlt die Vermarktung der westlichen Lí¤nder – inkl. die Schweiz – als Demokratien zum wohl gelungensten Betrug der Menschheitsgeschichte.

http://edmund.ch/m0.html

http://edmund.ch/more/1/ceterum-censeo.pdf

Alle Deine wohl begrí¼ndeten Argumente fíördern gleicherweise den erdrí¼ckenden Beweis dieser Feststellung zu Tage.

In diesem Sinne sind alle Gerichtsentscheide der Schweiz – welches Land ich nur noch als plutokratischen Schurkenstaat apostrophiere – logischerweise ungí¼ltig und unbeachtlich.

Fí¼r Dich heisst das, dass Du Dich durch kein einziges gegen Dich ausgesprochenes Urteil betroffen fí¼hlen musst.

Im Gegenteil! Du kannst davon ausgehen, dass sich alle diese Lakaien des plutokratischen Schurkenstaates schon jetzt und garantiert auch im Urteil der Geschichte fí¼rchterlich blamieren.

Keep cool!

Herzlich

Edmund Schíönenberger

Rechtsanwalt

Dear Rudolf Elmer

As I already proved in the 80s of the last century, the marketing of Western countries – including Switzerland – as democracies is probably one of the most successful frauds in the history of mankind.

http://edmund.ch/m0.html

http://edmund.ch/more/1/ceterum-censeo.pdf

All of your well-founded arguments likewise bring to light the overwhelming evidence of this statement.

In this sense, all court decisions of Switzerland – which country I apostrophize only as a plutocratic rogue state – are logically invalid and irrelevant.

For you this means that you do not have to feel affected by a single judgement pronounced against you.

On the contrary! You can assume that all these lackeys of the plutocratic rogue state are already now and guaranteed to embarrass themselves terribly in the judgment of history.

Keep cool.

Cordially

Edmund Schíönenberger

Attorney at law

Pingback: Links 8/8/2020 | naked capitalism

Pingback: Links 8/8/2020 - Breaking News log

Pingback: Links 8/8/2020 - Health News at Your Fingertips

Pingback: Links 8/8/2020 | naked capitalism | Litty News

Pingback: Links 8/8/2020 – Beachum News

Pingback: Links 8/8/2020 – Viral News Connection

Utterly corrupt shameful and disgusting behaviour.

Pingback: Y a-t-il eu une conspiration de la part du tribunal et du minist̬re public suisse? РThe Komisar Scoop

Pingback: Liegt eine Verschw̦rung zwischen den Schweizer Gerichten und der Schweizerischen Bundesanwaltschaft vor? РThe Komisar Scoop