By Lucy Komisar

Fault Lines, Feb 1, 2021.

2hr:18minutes in to 2:45

How to understand the GameStop Robinhood stock spike. It says a lot more about the corruption of the stock-trading system than you have read about in corporate media.

The number you have to look at is that over 130% of GameStop shares were in the market. Think of that. That’s the “float,” all the shares that can be traded. How could there be more than 100% of anything? How could there be 130%? That’s the key number. Because beyond 100% those are phantom shares. They’re not real shares. They’re created by naked short selling.

This is a corrupt system created by the SEC, because it allows the big hedge funds and it is also allowed by the Depositary Trust and Clearing Corporation (DTCC) which is owned by its members who are the prime brokers. The DTCC is the New York holding company charged with the clearance and settlement of securities.

Say 100mil shares are issued by a company. Maybe the insiders and some other owners own 50%. Maybe 50% are owned by share owners and deposited in broker accounts, clients of the prime brokers who have accounts in DTCC. The float.

They’re bought by hedge funds and individuals, deposited in broker accounts, then deposited by prime brokers in DTCC.

Years ago, before everything was on computer, messengers would take around stock certificates, pieces of paper, they would move the paper from one broker to another.

When they started doing computer transfers, no more paper, everything was digital. People got “entitlements.” People can ask for paper. Most do not.

Prime brokers in the DTCC have as a client the broker you went to. The broker would go to a prime broker who would move the digital entitlement from one prime broker to another.

But the total can’t be 130%! The DTCC should know there are only 100% of real shares in the float.

Two things happened. When there were paper certificates, people needed time for settlement. They moved certificates on bikes. There was a lot of writing instructions. Settlement took three days, T + 3. Shares had to go into the buying account within 3 days. More recently 2 days.

That is selling shares you don’t own. You sell them into the market and promise to pay in 2 days. Your brokers has to borrow the stock or locate where it is available.

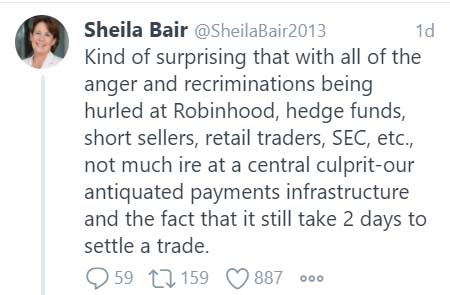

Here is what Sheila Bair says about it. She was Chair of the U.S. Federal Deposit Insurance Corporation and outspoken in 2008 on the need to hold banks accountable for their frauds.

Why is that necessary when transfers are computerized? It facilitates short selling. Georgetown University finance professor Jim Angel says T+2 should become T+1 and then T+midnight. That would kill short selling.

Short selling in enabled when people with accounts sign permissions “you can loan my shares.” They probably don’t know that. It’s in the small print. When a broker lends shares he collects interest.

Sometime the brokers don’t really get loans. Or for “locates,” they just say I know where the stock is. Maybe ten brokers “locate” the same shares. Or a share “borrowed” by one broker is then loaned to another broker who loans it to a third.

The person or hedge fund with phantom shares can lend them, sell them, use them for collateral. In the case above, there are three phantom shares, and all can be traded. So you are getting more shares in the market, which drives the prices down for legitimate owners, including the company.

Ex-clearing means not clearing through the DTCC, but clearing through prime brokers. There may be a dozen or less. They have so many clients, the regular brokers have so many clients, they can clear inside the brokerage or between and among themselves.

Goldman has clients a and b, sends stocks from a to b or maybe doesn’t really send, just claims it. Nobody can see what is going on. Or maybe Citi and Bank of America are dealing with each other. Makes it easier to do naked short selling. If they don’t send shares, nobody knows.

It became clear a dozen or more years ago. when you get to file your votes, every year at a proxy meeting or mail it in. Before the 2008 crash, a proxy meeting for Bank of America counted 130% of shares voted. That’s just who voted! Imagine how many shareholders thought they had votes!

[Q: Violates rights of shareholders?]

Remember the proxy question of a merger between Compaq and Hewlett Packard. If extra shares were around and your broker dealer or his prime broker was JP Morgan, an advisor on deal, JPM would get more if the merger went through. If JPM had more votes than real shares, do you think they would be so careful about your vote?

At a certain point the SEC said you can vote only as many votes as you have real shares. Suppose a broker has x clients who think they have shares of Hewlett Packard but they were never all delivered. The broker is allowed to send in votes for as many real shares as they have. Who tells them which to pick? You are client, you don’t know if you have a real share, you have only an entitlement.

Do you think company will just pick votes out of a hat? I think they will pick ones according to the vote on the merger, because “we will make money on that.”

[Q: What did Robinhood get out of this?]

If you’re not a paying customer, you’re the product. They were selling user trading data to the hedge funds so they could use it to manipulate markets. There was a lot of trading by dark pools owned by big traders who made millions trading in this stock. I read JP Morgan may have made millions on this. Robinhood worked to help big guys trade against the dumb money, manipulate trades.

But it got out of hand. One of reason Robinhood may have had to stop trades is they had to put in margins with brokers for trades they were in charge of.

Bernie Madoff wrote from prison in 2012: “It was perfectly proper to short [my clients’] securities or purchase those positions back from those clients or others with any profit or loss recorded on my books. … The point is that this was my practice prior to the time that I fell into my crime of staying Naked Short. The fact that the prosecutor and Trustee seemed clueless of this is why my frustration is so great.” He added that “most of my professional clients were well aware of how I traded.”

Naked shorting is not a secret and was one of Madoff’s big problems.

The industry average for short selling in the U.S. is between 20% and 25% of the volume of a particular security on a given day. But when people now are talking about shorting, they are not talking about naked short selling.

Problem is when you no longer need to send boys on bikes with paper certificates, T +2 is to allow the shorting that allows naked shorting, and everybody knows how this works.

Will Congress deal with naked shorting and the need to change T+2 to immediate transfer of shares?

[Q: “How is this legal”?]

The SEC is controlled by the big broker dealers. There is regulatory capture.

A major part of crash of 1929 was “watering the stock,” which meant creating out of thin air more stock than issued and selling it. A famous line was, “He that sells what isn’t his’n/ Must buy it back, or go to prison.”

That is happening now. (Not the prison part!) The SEC allows naked short selling in spite of a weak regulation that pretends to be against it. When you buy stock you think you bought, money from your account is transferred to your broker, who sends to his prime broker. It’s not transferred to the seller till you receive shares. But the broker can use it. Know what means, use of millions of dollars for free?

The SEC has a rule about “buy-ins.” If the buyer doesn’t get share, his broker can buy it in the market, sell the bill to the seller’s broker. But as both sides do it, they don’t buy in. A paper for the SEC said they don’t buy in. Each agrees not to buy in the other. Their clients don’t knowing didn’t get real shares. The client can’t use the money, the broker or prime broker can use the money.

[Q: “Who should go to jail?”]

Problem is jail is for criminal offenses. These regulations are civil; the rules SEC writes are civil. Violators can be fined. Goldman Sachs allowed hedge funds to make trades from computers where short sale were labeled long. They were fined, a cost of doing business.

Unless you make it a criminal offense….it should be criminal offense if they don’t “cover” trades. I think they shouldn’t allow short selling and should do immediate transfers.

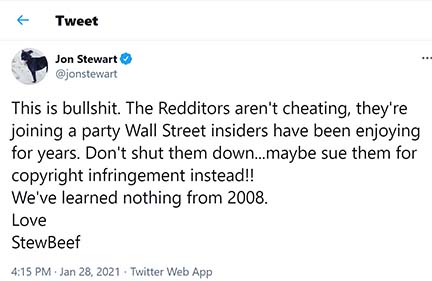

But allowing short selling is part of the system powerful traders can game. Note what Jon Stewart says.

The system brings down companies. If there is a short attack with naked short selling, more stocks are in the market, the price goes down. Naked shorting has killed some companies, often small companies that can’t fight back.

The SEC knows about this, there’s a lot of testimony. People who write for big papers think short selling is great because it keeps bad companies on their toes. It’s not how it’s used. It’s used to game the system.

An ordinary person who buys a stock wants it to go up. A short seller says how do we make the stock go down. That is not in the interest of individual investors or pension funds. The SEC knows about this.

The question now is whether the people Biden puts on the SEC recognize it is a scam. A kind of embezzlement: taking money from investors.

wow. Thank you. Concise. I’m now greatly informed.

Pingback: Special Solari Report: Game Stop & Naked Short Selling with Lucy Komisar – The Komisar Scoop

Pingback: Special Solari Report: GameStop & Naked Short Selling with Lucy Komisar – The Komisar Scoop

Please look into Joe Springers Tindies friends youtube

link

https://www.youtube.com/c/TendiesClub

We are fighting for AD Patients Joe Springer is helping get the word out.

Joe contacted Lucy, We need Her and your Help on these Short Hedge Funders and the SEC corruption on this, the short and distorts are after

Cassava Science They are in P3 to help patients with Alzheimer’s disease 1 of every 6 people will die from it.

After doing some research ( see below ) I realized how big of a problem this is and found the shorts are attacking another

pharma company I have invested it with several years of progress.

I don’t know how to help fight this ?

Please Join US !

Thank You

Best and Kind Regards

Daniel Brooks