By Lucy Komisar

April 28, 2022

Here’s a story the New York Times just missed. U.S. politicians and corporate media are promoting the targeting of “enablers” of Russian oligarchs who stash their money in offshore accounts. A Times article March 11th highlighted Michael Matlin, CEO of Concord Management, as such an “enabler,” who handles money of Roman Abramovich. But it missed serious corruption Matlin was involved in. Maybe because it stopped with “he helps the Russian oligarchs we hate.” Looking further would have revealed how he cheated Russia with the help of William Browder, a hero of the NYTimes, which has never challenged the Browder/Magnitsky hoax.

The Times said, “For years, a group of wealthy Russians have used Concord Management LLC, a financial advisory company in Tarrytown, New York, to secretly invest money in large US hedge funds and private equity firms.”

The Times said, “Wall Street bankers and hedge fund managers who have interacted with Concord and its founder, Michael Matlin, said it oversees between $4 billion and $8 billion.”

Screenshot of NYTimes article:

The Times did not mention that before Matlin set up Concord in 1999, he worked for Gabriel Capital, run by Jacob Merkin, who famously invested clients’ assets in Bernard Madoff’s corrupt Ponzi scheme. Matlin’s Concord also invested with Madoff. Or that he represented Gabriel in an embezzlement scam through which American “oligarchs” Kenneth Dart and William Browder stole funds from a Russian titanium company, Avisma. Beny Steinmetz, who with Edmond Safra supplied the $50 million that started Hermitage Fund in 1996, with Browder named to run it, owned 16 percent of Gabriel. Browder later bought out the Hermitage funders.

Bruce Marks, the attorney who represented Avisma, told me, “I am friends with Jamie Firestone.” [Firestone ran Firestone Duncan, the Moscow accounting firm that handled Browder’s Hermitage Fund.] “I was in Ukraine, stopped in London. We had a drink. He says he’s working with Browder advising the administration on imposing new sanctions. Legislative advisors to Treasury.”

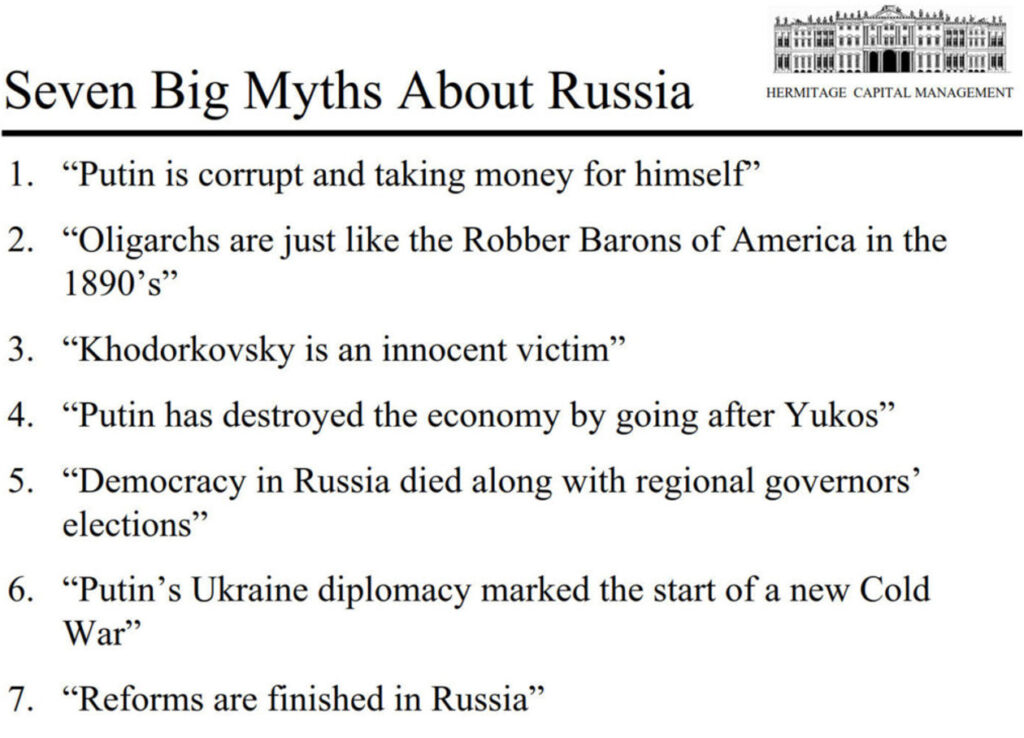

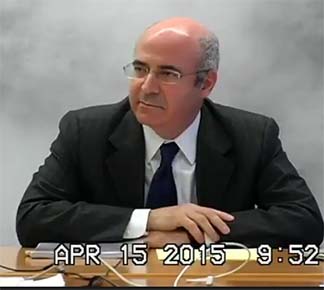

Browder was an effusive fan of Russian President Putin till the mid-2000s and proclaimed his praise in an April 2005 Powerpoint he gave prospective investors. He acknowledged it in a 2015 U.S. federal court deposition.

Browder would lose his visa in November 2005 after several years of refusing to pay $40mil in taxes on his stock buy profits and also attempting to get seats on Russian energy conglomerate Gazprom with shares bought illicitly as if he were a Russian national.

Now, he has called for the U.S. sanctioning western “enablers” working for the Russians. It is worthwhile noting that while Matlin is being attacked for working for a Russian “oligarch” (which till now is not illegal in the U.S.), he participated in a very fraudulent scheme in partnership with Browder and billionaire Kenneth Dart (of the Dart Cup fortune), who were the chief investors in Avisma, a Russian titanium company. Small investors included the Anderson Group, a New York investment firm, and Gabriel Capital. This should be illegal under the U.S. Corrupt Practices Act. But Browder is an apparently protected person whose corruption has never been targeted by the Justice Department.

The investors bought the company from Russian “oligarch” Mikhail Khodorkovsky, who operated a “transfer pricing” scheme through which minority shareholders and tax authorities were cheated when profits were siphoned via an Isle of Man shell company. Products were sold at fake low prices to the shell company, then sold at market prices to real buyers.

When Peter Bond, who ran the shell company, TMC (The Metals Company), didn’t pass on all the embezzled cash, the new investors sued him in the Isle of Man. And when a Russian company VSMPO, which used titanium in its production, bought Avisma, it discovered the court documents that argued the investors would not have bought Avisma without the transfer pricing scam. It sued Dart, Browder and collaborators under the RICO statute and they settled.

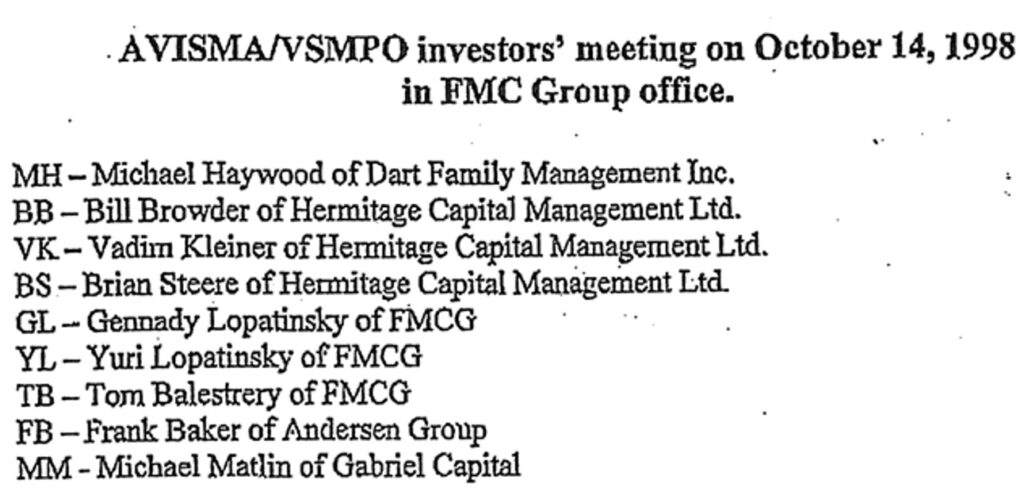

One of the court documents revealed a meeting where Dart’s representative Michael Haywood, Browder, Frank Baker for Anderson and Matlin for Gabriel are in a discussion along with the Lopatinsky brothers of Creditanstalt Bank, on how to get the embezzled cash from Peter Bond, the Isle of Man bag man.

Baker: “… you guys from the very beginning identified that huge skim-off operation. One of the things ’that was amazing was the profitability of AVISMA despite the skim-off.

Browder: If you look at the E&Y [accounting firm Ernest & Young] report about half of the profits come from over-paying for raw materials going in.

Gennady Lopatinksy: No, no that is not correct It is about 10-15 per cent of the profits. One transaction which Menatep did. [The Lopatinsky brothers worked for the Creditanstalt Bank in Moscow, which had arranged the AVISMA investment.]

Baker: Bring us up to speed about TMC, Yuri. …we bought the company, we created an offshore to raise a lot of money it is clear from Tom’s documents and from the inappropriate pricing setup as a skimming device. Huge percentage of the profits of AVISMA ended up in TMC. And we are sort of relying on the good will of the manager there to say you guys raise your right hand I will send you a packet of money.

Baker: Guys just for the record we studied the E&Y report. Remember I said earlier that Creditanstalt had authorized E&Y because the cut-off issues were very complicated. They have rendered a report, it is a hard report to follow. It is not an audit and it is certainly not a cost-accounting document but it is very good with respect to cut-offs. [Cut-offs is about when the embezzled money stopped going to Menatep/Khodorkovsky and started going to Dart/Browder.]

Baker: What E&Y says, roughly, is that there is US$7 million of extra payments which actually went on to Menatep and that is a big number in this transaction.

Yuri Lopatinsky: Where we need to make a decision is what to do with that money – VSMPO/AVISMA or us?

Baker: The US$10 to US$11 million? ’

Yuri Lopatinsky: Whatever is there.

Browder – It goes pro-rata to the investors. [The money belongs to Avisma, but Browder wants to steal it.]

Yuri Lopatinsky: Given that the full year profits are frozen at Menatep. The question is do we give all the money out to all the investors pro-rata, do investors loan the money back to the company or just give the money back?

Browder: I think the logical way to do this is that we took the risk we get the money paid back and if they want more money they can either talk about a new share issue and we can purchase the new shares or… [Browder repeats he wants the investors to steal the money.]

But Bond refused to go along, so the investors went to court in the Isle of Man. And he settled by paying them about $8 million. When VSMPO bought Avisma, its Philadelphia lawyer Bruce Marks discovered the court documents and filed a RICO suit in New Jersey against Dart, Browder et al. And they settled in February 2000. The evidence was available in the court filings. I wrote about this for 100Reporters in 2014. See links to more documents here.

Sanctions were applied against bankers, businessmen and officials close to Vladimir Putin to pressure him over the Crimean peninsula, (60% ethnic Russians, 24% ethnic Ukrainians) which, after the 2014 violent overthrow of the pro-Russian Kyiv government, voted to be part of Russia. (The U.S. disputes the vote’s validity.) I raised then the fact of western “enablers” using the offshore system to help sanctions targets hide their wealth.

So, when questions are now raised about Michael Matlin’s work for Russian “oligarchs” stashing their profits offshore, it is appropriate to note his role representing a New York investment company in a scam to cheat Russia and minority investors (including foreigners) by embezzling money via a shell company in the offshore British crown colony of the Isle of Man. Not to mention William Browder’s “enabling” role in the embezzlement.

I await the follow-up from the Times or any other U.S. media on this story. Or a comment from Michael Matlin! Forget about fraudster Bill Browder!

See also at John Helmer’s “Dances With Bears.”

For the links above, go to John Helmer’s site.

Pingback: Dances With Bears » THE MATLIN PLOT, THE BROWDER PLOT AND THE NEW YORK TIMES PLOT

Pingback: Kuinka Häivyttää Totuus Julkisuudesta

Pingback: Dances With Bears » THE MATLIN PLOT, THE BROWDER PLOT AND THE NEW YORK TIMES PLOT

Pingback: THE MATLIN PLOT, THE BROWDER PLOT AND THE NEW YORK TIMES PLOT – Dances With Bears